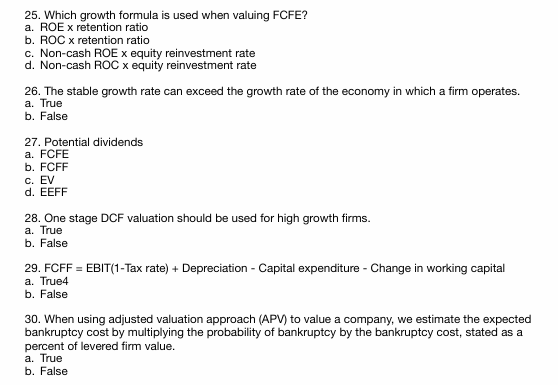

Question: 2 5 . Which growth formula is used when valuing FCFE? a . ROE ( times ) retention ratio b .

Which growth formula is used when valuing FCFE?

a ROE times retention ratio

bmathrmROCtimes retention ratio

c Noncash ROE x equity reinvestment rate

d Noncash ROC x equity reinvestment rate

The stable growth rate can exceed the growth rate of the economy in which a firm operates.

a True

b False

Potential dividends

a FCFE

b FCFF

c EV

d EEFF

One stage DCF valuation should be used for high growth firms.

a True

b False

FCFF EBITTax rate Depreciation Capital expenditure Change in working capital

a True

b False

When using adjusted valuation approach APV to value a company, we estimate the expected bankruptcy cost by multiplying the probability of bankruptcy by the bankruptcy cost, stated as a percent of levered firm value.

a True

b False

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock