Question: 2 . 6 6 Consider the following transactions for Huskies Insurance Company: points Print Income taxes for the year total $ 5 0 , 0

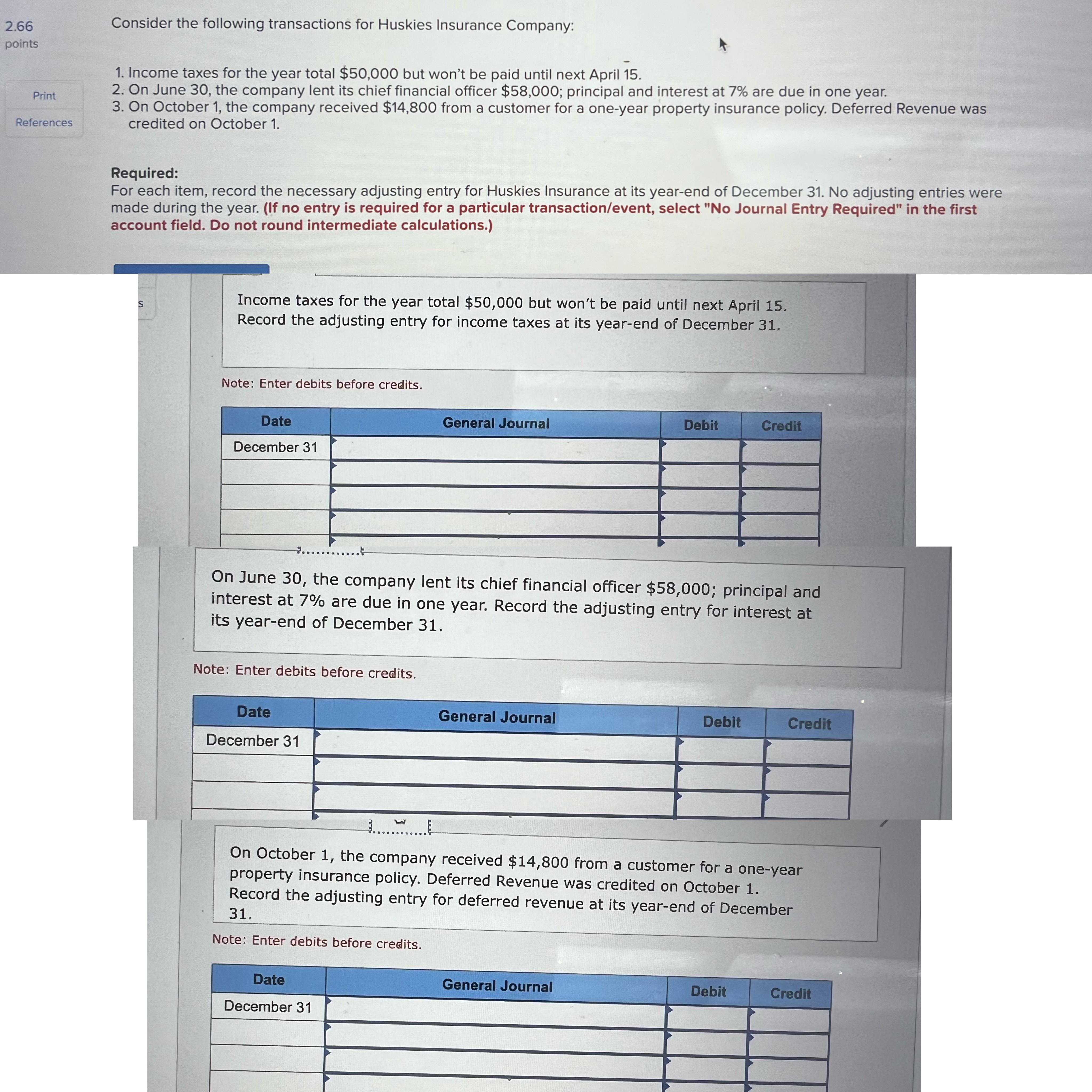

Consider the following transactions for Huskies Insurance Company:

points

Print

Income taxes for the year total $ but won't be paid until next April

On June the company lent its chief financial officer $; principal and interest at are due in one year.

On October the company received $ from a customer for a oneyear property insurance policy. Deferred Revenue was credited on October

Required:

For each item, record the necessary adjusting entry for Huskies Insurance at its yearend of December No adjusting entries were made during the year. If no entry is required for a particular transactionevent select No Journal Entry Required" in the first account field. Do not round intermediate calculations.

Income taxes for the year total $ but won't be paid until next April Record the adjusting entry for income taxes at its yearend of December

Note: Enter debits before credits.

tableDateGeneral Journal,Debit,CreditDecember

On June the company lent its chief financial officer $; principal and interest at are due in one year. Record the adjusting entry for interest at its yearend of December

Note: Enter debits before credits.

tableDateGeneral Journal,Debit,CreditDecember

On October the company received $ from a customer for a oneyear property insurance policy. Deferred Revenue was credited on October

Record the adjusting entry for deferred revenue at its yearend of December

Note: Enter debits before credits.

tableDateGeneral Journal,Debit,CreditDecember

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock