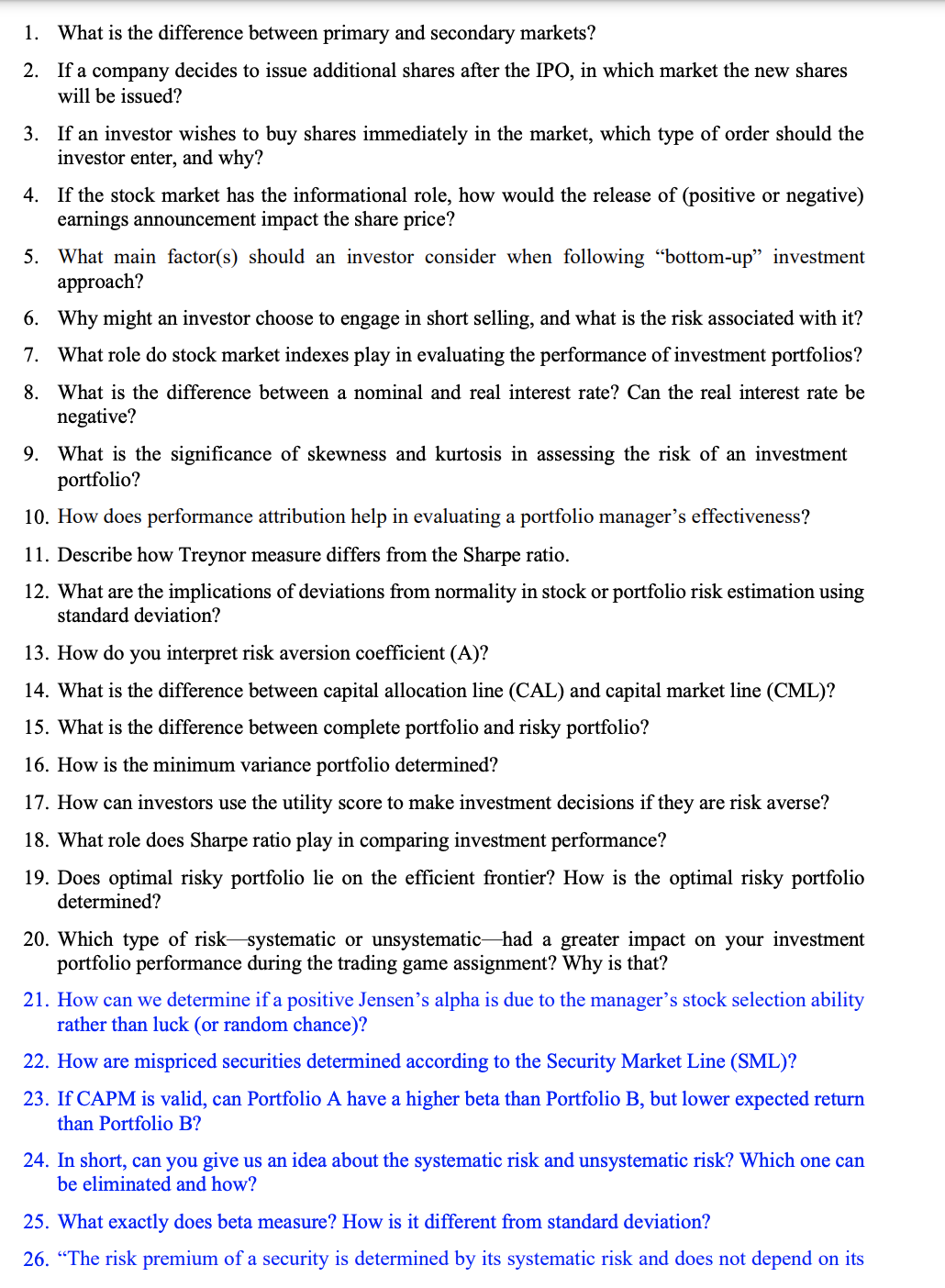

Question: 2 7 . Describe how the Arbitrage Pricing Theory ( APT ) differs from CAPM. 2 8 . Differentiate between the weak, semi - strong,

Describe how the Arbitrage Pricing Theory APT differs from CAPM.

Differentiate between the weak, semistrong, and strong forms of the EMH.

An investor holds on to stocks that are down from the purchase price in the hopes that they will recover. Which behavioral characteristic is the basis for this investor's decisionmaking?

Why does an actively managed fund underperform a passively managed fund in a semistrong efficient market?

If an investor can consistently earn abnormal returns using technical analysis tools, how efficient is the market?

What is the difference between contrarian and momentum investors?

If your investment portfolio eg trading game portfolio can generate positive and significant Jensen's alpha without having private information, what does it signal about the form of market efficiency in the short run?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock