Question: ( 2 7 marks ) Question 1 Two work colleagues, Tendai and Thembi, have a difference of opinion about the inclusion of debt in the

marks

Question

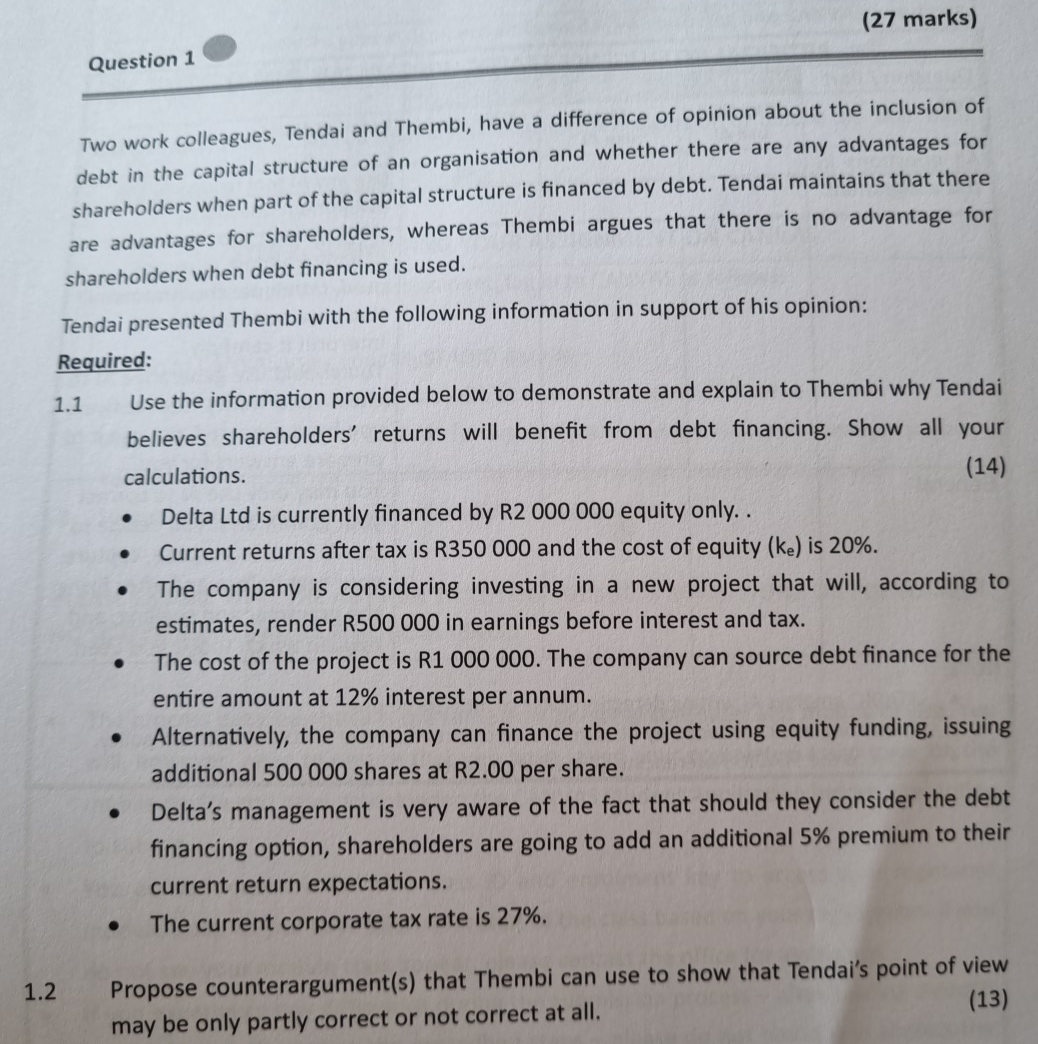

Two work colleagues, Tendai and Thembi, have a difference of opinion about the inclusion of debt in the capital structure of an organisation and whether there are any advantages for shareholders when part of the capital structure is financed by debt. Tendai maintains that there are advantages for shareholders, whereas Thembi argues that there is no advantage for shareholders when debt financing is used.

Tendai presented Thembi with the following information in support of his opinion:

Required:

Use the information provided below to demonstrate and explain to Thembi why Tendai believes shareholders' returns will benefit from debt financing. Show all your calculations.

Delta Ltd is currently financed by R equity only.

Current returns after tax is R and the cost of equity is

The company is considering investing in a new project that will, according to estimates, render R in earnings before interest and tax.

The cost of the project is R The company can source debt finance for the entire amount at interest per annum.

Alternatively, the company can finance the project using equity funding, issuing additional shares at R per share.

Delta's management is very aware of the fact that should they consider the debt financing option, shareholders are going to add an additional premium to their current return expectations.

The current corporate tax rate is

Propose counterarguments that Thembi can use to show that Tendai's point of view may be only partly correct or not correct at all.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock