Question: 2 7 of 4 9 Concepts completed Multiple Choice Question What are the tax and penalty effects of nonqualified distributions of Roth 4 0 1

of Concepts completed

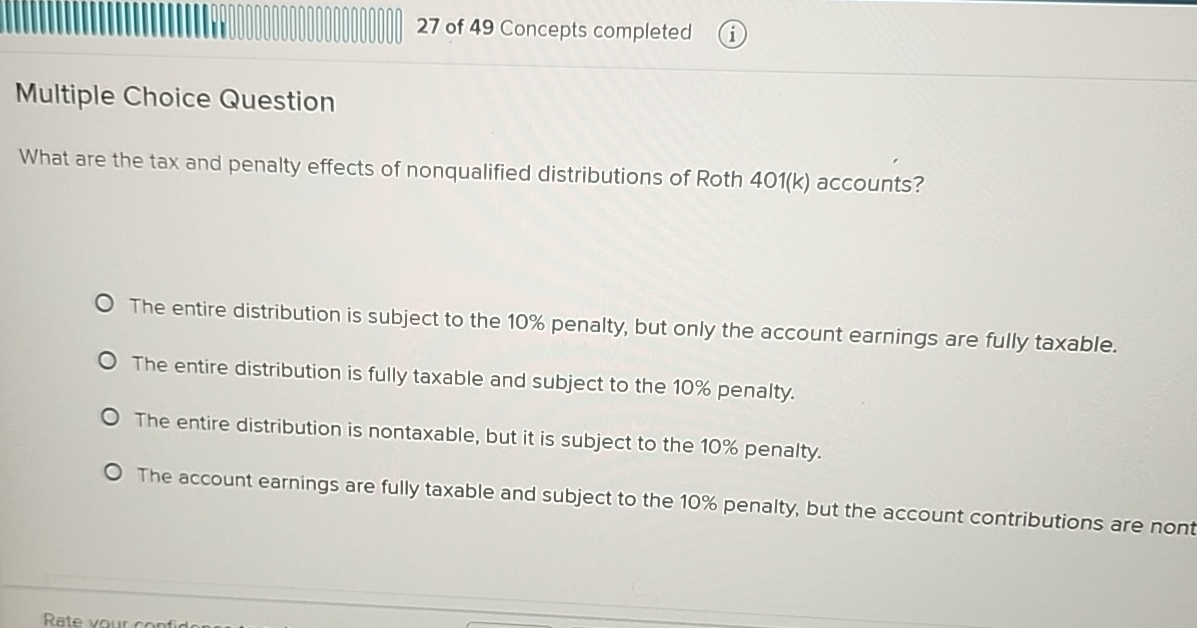

Multiple Choice Question

What are the tax and penalty effects of nonqualified distributions of Roth k accounts?

The entire distribution is subject to the penalty, but only the account earnings are fully taxable.

The entire distribution is fully taxable and subject to the penalty.

The entire distribution is nontaxable, but it is subject to the penalty.

The account earnings are fully taxable and subject to the penalty, but the account contributions are nont

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock