Question: 2. (75 points) Consider a case where a SRP is considering constructing another dam to generate hydropower along the CAP canal. This decision will create

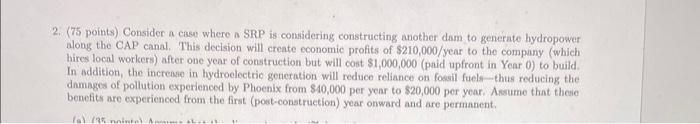

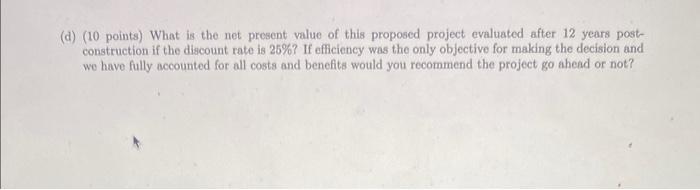

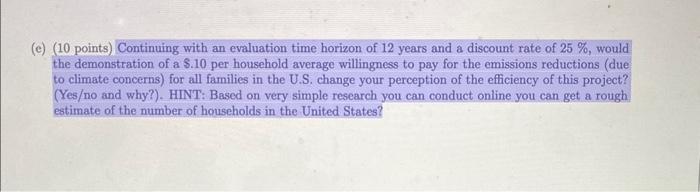

2. (75 points) Consider a case where a SRP is considering constructing another dam to generate hydropower along the CAP canal. This decision will create economic profits of $210,000/ year to the company (which hires local workers) after one year of construction but will cost $1,000,000 (paid upfront in Year 0 ) to build. In addition, the increase in hydroelectric generation will reduce reliance on fossil fuels-thus reducing the damages of pollution experienced by Phoenix from $40,000 per year to $20,000 per year. Assume that theio benefits are experienced from the first (post-construetion) year onward and are permatient. (d) (10 points) What is the net prosent value of this proposed project evaluated after 12 years postconstruction if the discount rate is 25% ? If efficiency was the only objective for making the decision and we have fully accounted for all costs and benefits would you recommend the project go ahead or not? (e) ( 10 points) Continuing with an evaluation time horizon of 12 years and a discount rate of 25%, would the demonstration of a $.10 per household average willingness to pay for the emissions reductions (due to climate concerns) for all families in the U.S. change your perception of the efficiency of this project? (Yeso and why?). HINT: Based on very simple research you can conduct online you can get a rough estimate of the number of households in the United States? 2. (75 points) Consider a case where a SRP is considering constructing another dam to generate hydropower along the CAP canal. This decision will create economic profits of $210,000/ year to the company (which hires local workers) after one year of construction but will cost $1,000,000 (paid upfront in Year 0 ) to build. In addition, the increase in hydroelectric generation will reduce reliance on fossil fuels-thus reducing the damages of pollution experienced by Phoenix from $40,000 per year to $20,000 per year. Assume that theio benefits are experienced from the first (post-construetion) year onward and are permatient. (d) (10 points) What is the net prosent value of this proposed project evaluated after 12 years postconstruction if the discount rate is 25% ? If efficiency was the only objective for making the decision and we have fully accounted for all costs and benefits would you recommend the project go ahead or not? (e) ( 10 points) Continuing with an evaluation time horizon of 12 years and a discount rate of 25%, would the demonstration of a $.10 per household average willingness to pay for the emissions reductions (due to climate concerns) for all families in the U.S. change your perception of the efficiency of this project? (Yeso and why?). HINT: Based on very simple research you can conduct online you can get a rough estimate of the number of households in the United States

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts