Question: 2. [8 marks) For this question, you may assume that interest rates are zero. Consider a butterfly position, constructed from a put options struck at

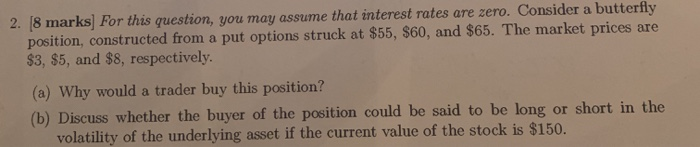

2. [8 marks) For this question, you may assume that interest rates are zero. Consider a butterfly position, constructed from a put options struck at $55, $60, and $65. The market prices are $3, $5, and $8, respectively. (a) Why would a trader buy this position? (b) Discuss whether the buyer of the position could be said to be long or short in the volatility of the underlying asset if the current value of the stock is $150

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock