Question: 2. ( 8 points) A widget machine will cost $250,000. The anticipated increase in revenue will be $95,000/ year for 5 -years. Annual expenses will

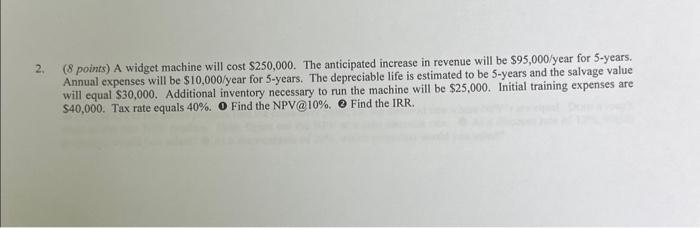

2. ( 8 points) A widget machine will cost $250,000. The anticipated increase in revenue will be $95,000/ year for 5 -years. Annual expenses will be $10,000/ year for 5 -years. The depreciable life is estimated to be 5 -years and the salvage value will equal $30,000. Additional inventory necessary to run the machine will be $25,000. Initial training expenses are $40,000. Tax rate equals 40%. O Find the NPV@ 10%. 2 Find the IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts