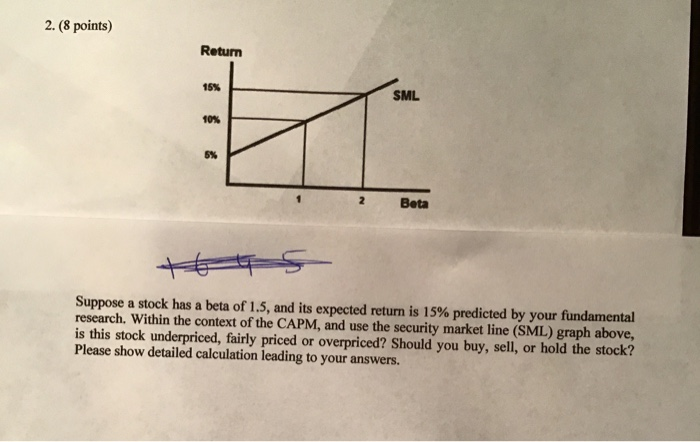

Question: 2. (8 points) Return SML Beta Suppose a stock has a beta of 1.5, and its expected return is 15% predicted by your fundamental research.

2. (8 points) Return SML Beta Suppose a stock has a beta of 1.5, and its expected return is 15% predicted by your fundamental research. Within the context of the CAPM, and use the security market line (SML) graph above, is this stock underpriced, fairly priced or overpriced? Should you buy, sell, or hold the stock? Please show detailed calculation leading to your answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts