Question: 2 9 . In November, ( 2 0 times 6 ) , married couple, John and Mary Mason, separate. Mary supports their

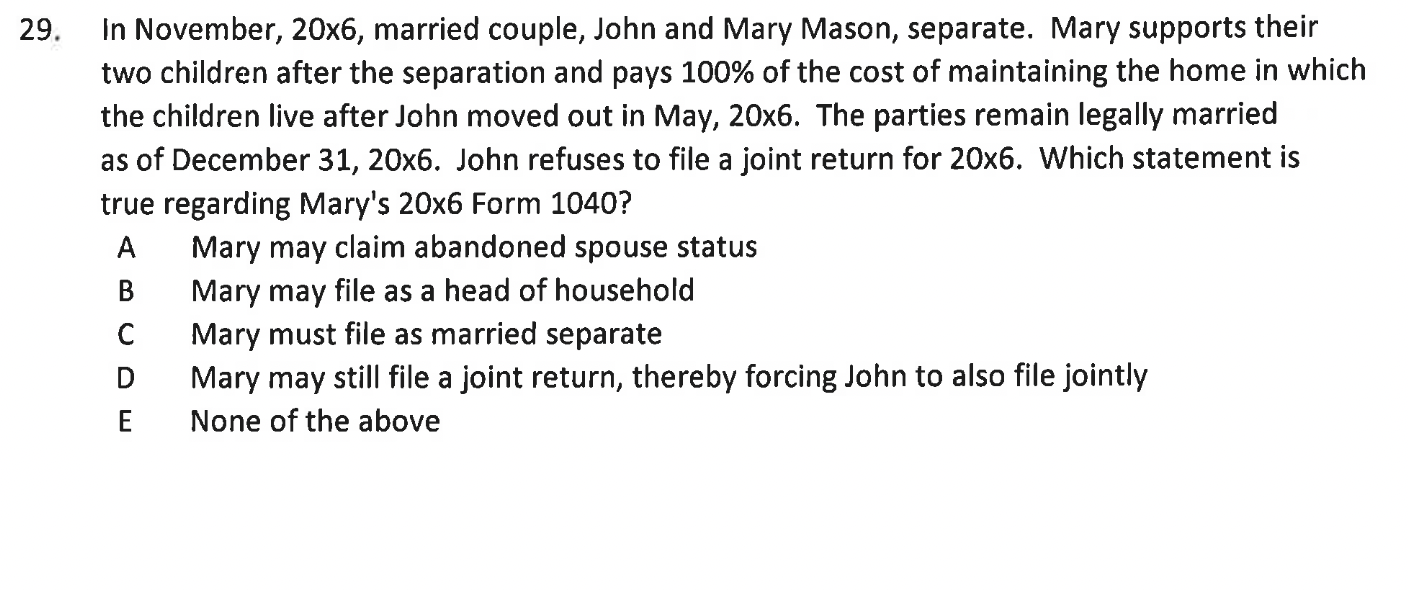

In November, times married couple, John and Mary Mason, separate. Mary supports their two children after the separation and pays of the cost of maintaining the home in which the children live after John moved out in May, times The parties remain legally married as of December x John refuses to file a joint return for x Which statement is true regarding Mary's times Form

A Mary may claim abandoned spouse status

B Mary may file as a head of household

C Mary must file as married separate

D Mary may still file a joint return, thereby forcing John to also file jointly

E None of the above

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock