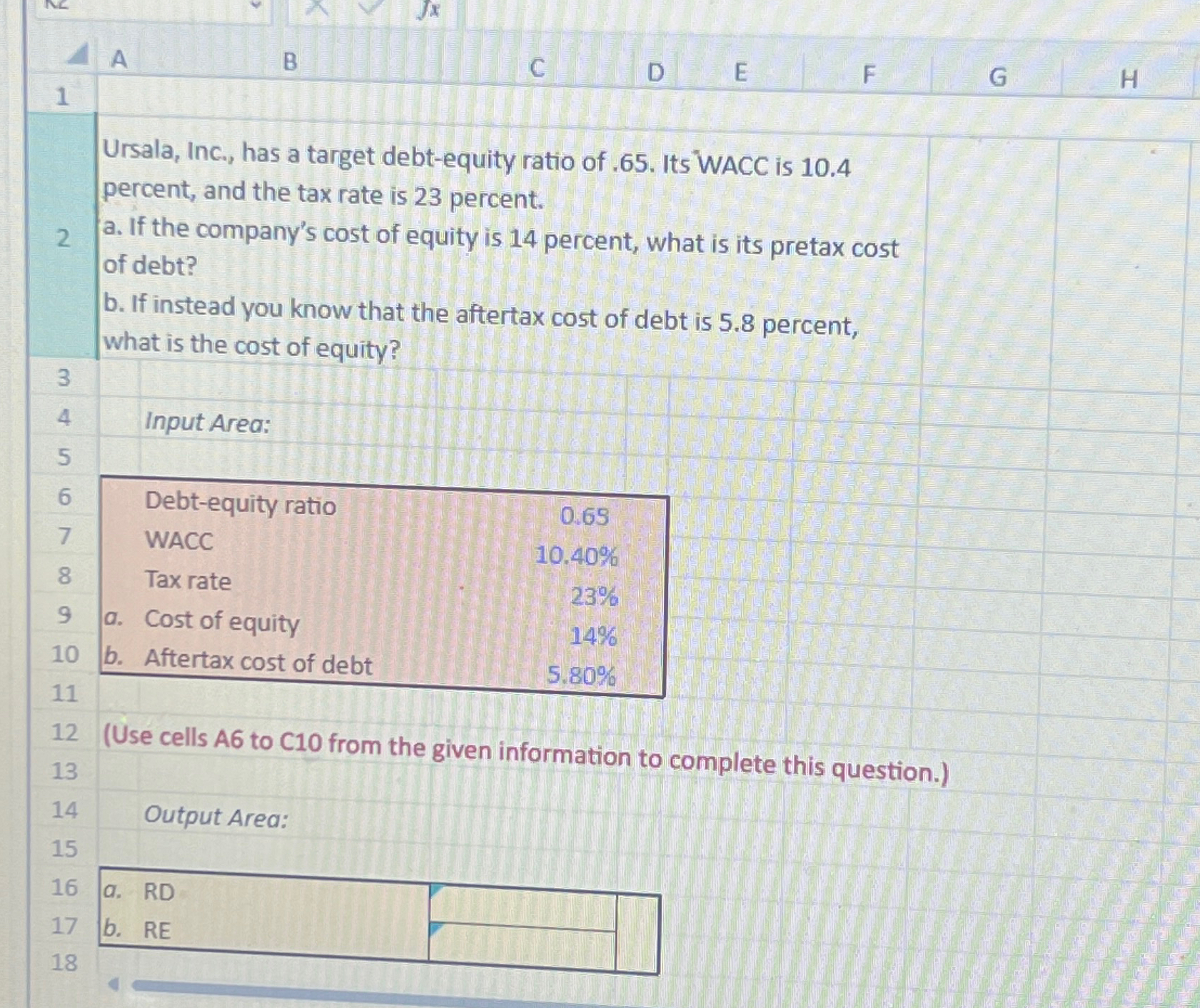

Question: 2 A 1 < B C DE F G H Ursala, Inc., has a target debt-equity ratio of .65. Its WACC is 10.4 percent,

2 A 1 < B C DE F G H Ursala, Inc., has a target debt-equity ratio of .65. Its WACC is 10.4 percent, and the tax rate is 23 percent. a. If the company's cost of equity is 14 percent, what is its pretax cost of debt? b. If instead you know that the aftertax cost of debt is 5.8 percent, what is the cost of equity? 3 4 Input Area: 5 6 Debt-equity ratio 0.69 7 WACC 10.40% 8 Tax rate 23% 9 a. Cost of equity 14% 10 b. Aftertax cost of debt 5.80% 11 12 (Use cells A6 to C10 from the given information to complete this question.) 13 14 Output Area: 15 16 a. RD 17 b. RE 18

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts