Question: 2. a. (5 pts) Consider a bond with face value $50 maturing in 10 years and $2.5 coupons paid yearly, traded at par. If we

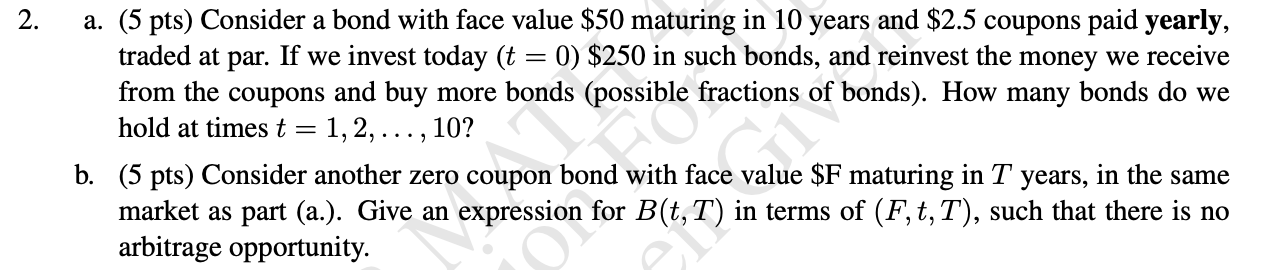

2. a. (5 pts) Consider a bond with face value $50 maturing in 10 years and $2.5 coupons paid yearly, traded at par. If we invest today (t = 0) $250 in such bonds, and reinvest the money we receive from the coupons and buy more bonds (possible fractions of bonds). How many bonds do we hold at times t= 1, 2, ..., 10? b. (5 pts) Consider another zero coupon bond with face value $F maturing in T years, in the same market as part (a.). Give an expression for B(t, T) in terms of (F, t,T), such that there is no arbitrage opportunity. de noe som eo

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts