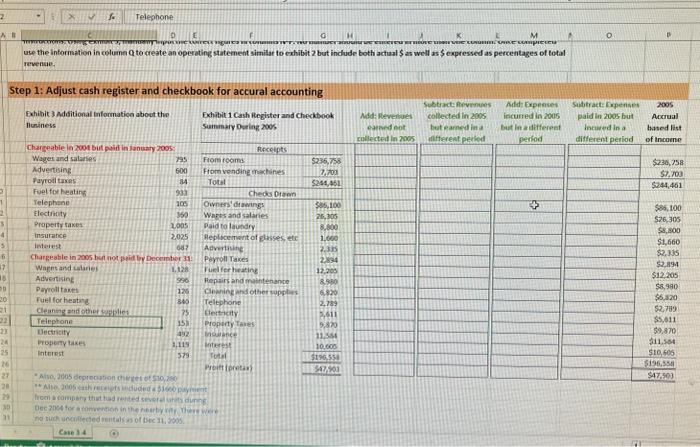

2 A B 0 1 2 3 4 5 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 : 4 X fx D F G H K M C instructions. Osing canon 3, manually Ipat the connectingates in comunMS NT. NO number should be entercom more than one coromm. Orice completed use the information in column Q to create an operating statement similar to exhibit 2 but include both actual $ as well as $ expressed as percentages of total revenue. Step 1: Adjust cash register and checkbook for accural accounting Exhibit 3 Additional Information about the Business Exhibit 1 Cash Register and Checkbook Summary During 2005 Telephone Chargeable in 2004 but paid in January 2005: Wages and salaries Advertising Payroll taxes Fuel for heating Telephone Electricity Property taxes Insurance 795 600 84 933 105 360 1,005 2,025 687 Interest Chargeable in 2005 but not paid by December 31: Wages and salaries Advertising Payroll taxes Fuel for heating Cleaning and other supplies Telephone Electricity Property taxes Interest E 1,128 996 126 840 75 153 492 1,119 579 From rooms From vending machines Total Receipts Checks Drawn Owners' drawings Wages and salaries Paid to laundry Replacement of glasses, etc Advertising Payroll Taxes Fuel for heating Repairs and maintenance Cleaning and other supplies Telephone Electricity Property Taxes Insurance Interest Total Proift (pretax) * Also, 2005 depreciation charges of $30,280 ** Also, 2005 cash receipts included a $1660 payment from a company that had rented several units during Dec 2004 for a convention in the nearby city. There were no such uncollected rentals as of Dec 31, 2005. Case 3-4 $236,758 7,703 $244,461 $86,100 26,305 8,800 1,660 2,335 2,894 12,205 8,980 6,820 2,789 5,611 9,870 11,584 10,605 $196,558 $47,903 Add: Revenues earned not collected in 2005 Subtract: Revenues collected in 2005 but earned in a different period Add: Expenses incurred in 2005 but in a different period + WWWW O Subtract: Expenses paid in 2005 but incured in a different period P 2005 Accrual based list of Income $236,758 $7,703 $244,461 $86,100 $26,305 $8,800 $1,660 $2,335 $2,894 $12,205 $8,980 $6,820 $2,789 $5,611 $9,870 $11,584 $10,605 $196,558 $47,903

f. Telephone S II Q 11 D revenus: Step 1: Adjust cash register and checkbook for accural accounting Exhibit 3 Adefitional inlormatice about the nuniness Chargeabie la zo04 but puid in ianuary 2005 : Wager and salaries Advertising Fayrodl tares: Fuel for healing Telephane Electringty Properity saxes. insurance inteies. Chargeable in 2005 but nod puid br beceunto Warnt and ulanes Advertising Parrolltanes Fuellfor heative Cleaning atid other supplies Teleptone Bectricity hoperty taxes Interest Exhibit 1 Cash Hegister and Checkbook Suminary Deving 200 , *Aiso, 2tos deprocuson oheret of 510,280 Cane 14 f. Telephone S II Q 11 D revenus: Step 1: Adjust cash register and checkbook for accural accounting Exhibit 3 Adefitional inlormatice about the nuniness Chargeabie la zo04 but puid in ianuary 2005 : Wager and salaries Advertising Fayrodl tares: Fuel for healing Telephane Electringty Properity saxes. insurance inteies. Chargeable in 2005 but nod puid br beceunto Warnt and ulanes Advertising Parrolltanes Fuellfor heative Cleaning atid other supplies Teleptone Bectricity hoperty taxes Interest Exhibit 1 Cash Hegister and Checkbook Suminary Deving 200 , *Aiso, 2tos deprocuson oheret of 510,280 Cane 14