Question: 2) a) b) For this question use the information about Stock UP and DOWN from question 1), particularly the daily returns you calculated in part

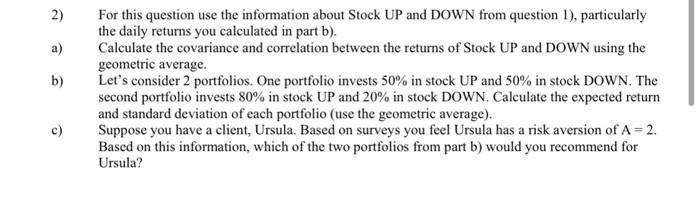

2) a) b) For this question use the information about Stock UP and DOWN from question 1), particularly the daily returns you calculated in part b). Calculate the covariance and correlation between the returns of Stock UP and DOWN using the geometric average. Let's consider 2 portfolios. One portfolio invests 50% in stock UP and 50% in stock DOWN. The second portfolio invests 80% in stock UP and 20% in stock DOWN. Calculate the expected return and standard deviation of each portfolio (use the geometric average). Suppose you have a client, Ursula, Based on surveys you feel Ursula has a risk aversion of A = 2. Based on this information, which of the two portfolios from part b) would you recommend for Ursula? c) 2) a) b) For this question use the information about Stock UP and DOWN from question 1), particularly the daily returns you calculated in part b). Calculate the covariance and correlation between the returns of Stock UP and DOWN using the geometric average. Let's consider 2 portfolios. One portfolio invests 50% in stock UP and 50% in stock DOWN. The second portfolio invests 80% in stock UP and 20% in stock DOWN. Calculate the expected return and standard deviation of each portfolio (use the geometric average). Suppose you have a client, Ursula, Based on surveys you feel Ursula has a risk aversion of A = 2. Based on this information, which of the two portfolios from part b) would you recommend for Ursula? c)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts