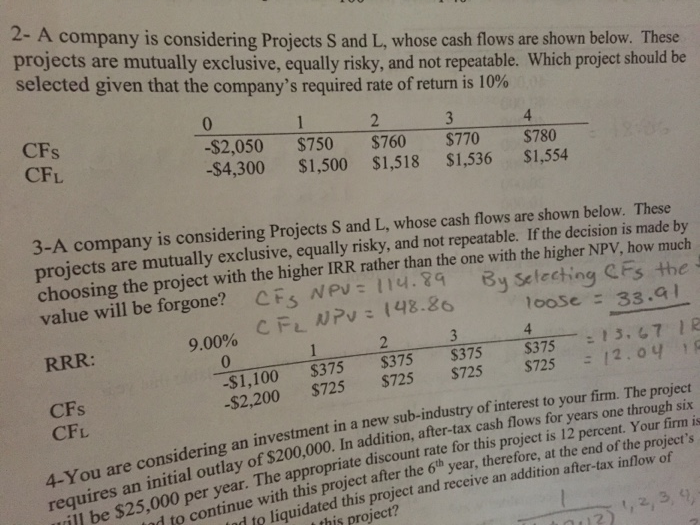

Question: 2- A company is considering Projects S and L. whose cash flows are shown below. These projects are mutually exclusive, equally riskv. and not repeatable.

2- A company is considering Projects S and L. whose cash flows are shown below. These projects are mutually exclusive, equally riskv. and not repeatable. Which project should be selected given that the company's required rate of return is 10% 1 2 3 -$2,050 $750 $760 CFs $770 $780 -$4,300 $1,500 $1,518 CFL $1,536 $1,554 3-A company is considering Projects S and L. whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. If the decision is made by choosing the project with the higher IRR rather than the one with the higher NPV, how much By Selecting CFs the CFS NPV = 114.99 value will be forgone? 1oose: 33.91 CE, NPV = 148.80 3 1 2 $375 E13.67 IR $375 RRR: 0 = 12.04 $725 $725 $725 $725 CFs 9.00% CFLNPU: 148.80 $375 $375 -$1,100 -$2,200 CFL 4-You are considering an investment in a nev requires an initial outlay of $200,000. In addit will be $25,000 per year. The appropriate discount rat ad to continue with this project after the 6th, investment in a new sub-industry of interest to your firm. The project 200.000. In addition, after-tax cash flows for years one through six appropriate discount rate for this project is 12 percent. Your firm is this project after the 6 year, therefore, at the end of the project's tad to liquidated this project and receive an addition after-tax inflow of u be $23, to contine to liquidachis project? 5 1,2,3,4 12)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts