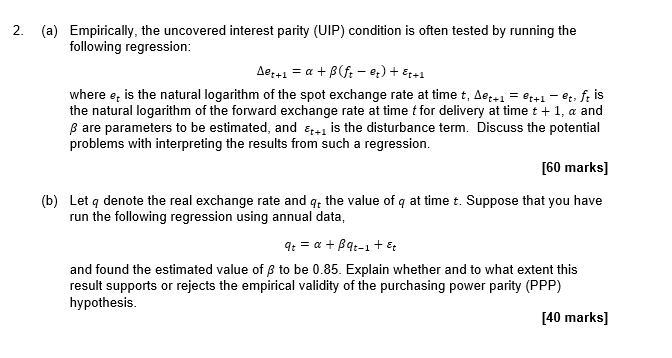

Question: 2. (a) Empirically, the uncovered interest parity (UIP) condition is often tested by running the following regression: Let+1 = a +36f-) +Et+1 where e, is

2. (a) Empirically, the uncovered interest parity (UIP) condition is often tested by running the following regression: Let+1 = a +36f-) +Et+1 where e, is the natural logarithm of the spot exchange rate at time t, Aet+1 = 8+1 Bt. fois the natural logarithm of the forward exchange rate at time t for delivery at time t +1, a and B are parameters to be estimated, and Et+1 is the disturbance term. Discuss the potential problems with interpreting the results from such a regression. [60 marks] (b) Let q denote the real exchange rate and q, the value of q at time t. Suppose that you have run the following regression using annual data, 9+ = a + B9t-1 + Et and found the estimated value of to be 0.85. Explain whether and to what extent this result supports or rejects the empirical validity of the purchasing power parity (PPP) hypothesis. [40 marks] 2. (a) Empirically, the uncovered interest parity (UIP) condition is often tested by running the following regression: Let+1 = a +36f-) +Et+1 where e, is the natural logarithm of the spot exchange rate at time t, Aet+1 = 8+1 Bt. fois the natural logarithm of the forward exchange rate at time t for delivery at time t +1, a and B are parameters to be estimated, and Et+1 is the disturbance term. Discuss the potential problems with interpreting the results from such a regression. [60 marks] (b) Let q denote the real exchange rate and q, the value of q at time t. Suppose that you have run the following regression using annual data, 9+ = a + B9t-1 + Et and found the estimated value of to be 0.85. Explain whether and to what extent this result supports or rejects the empirical validity of the purchasing power parity (PPP) hypothesis. [40 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts