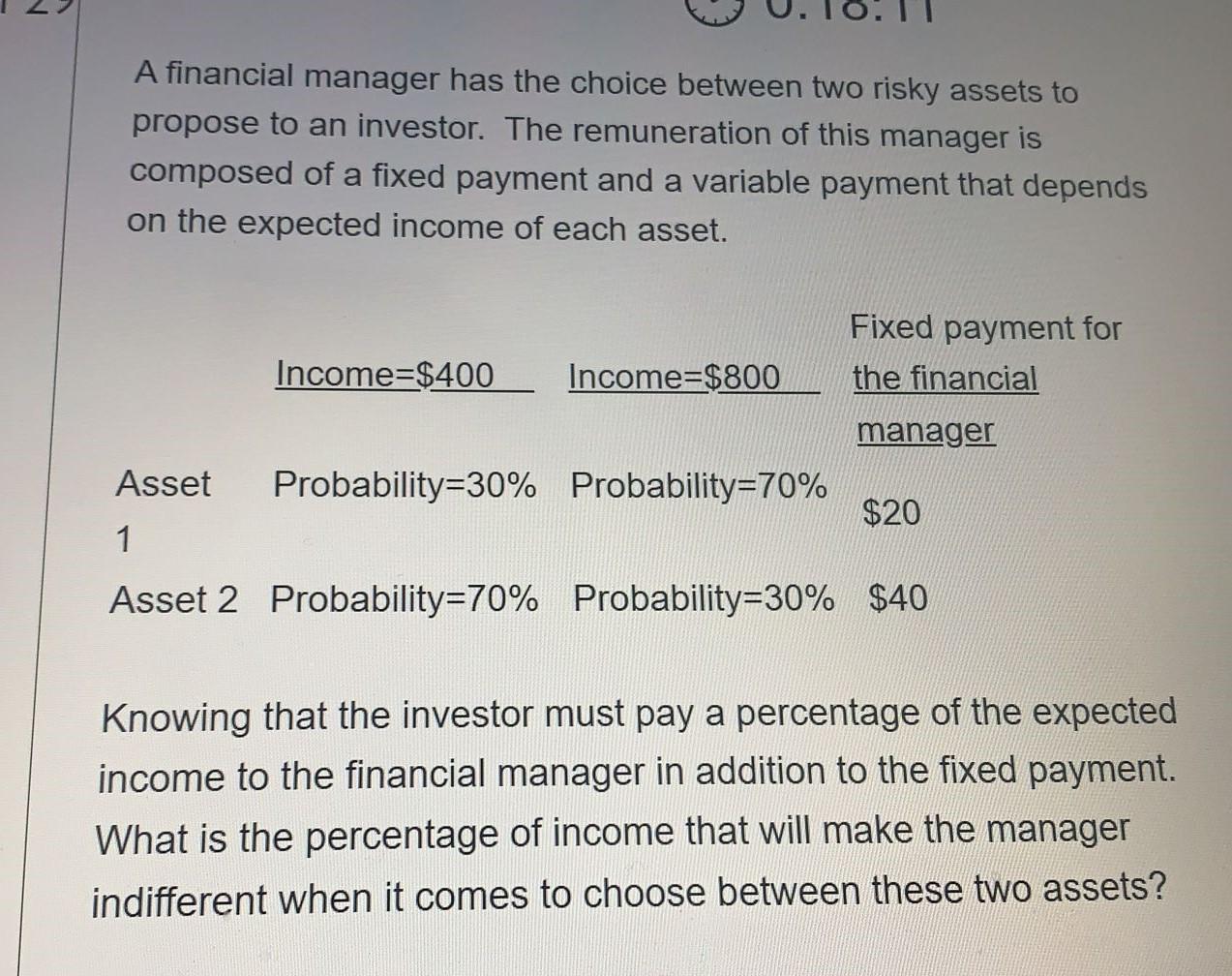

Question: 2 A financial manager has the choice between two risky assets to propose to an investor. The remuneration of this manager is composed of a

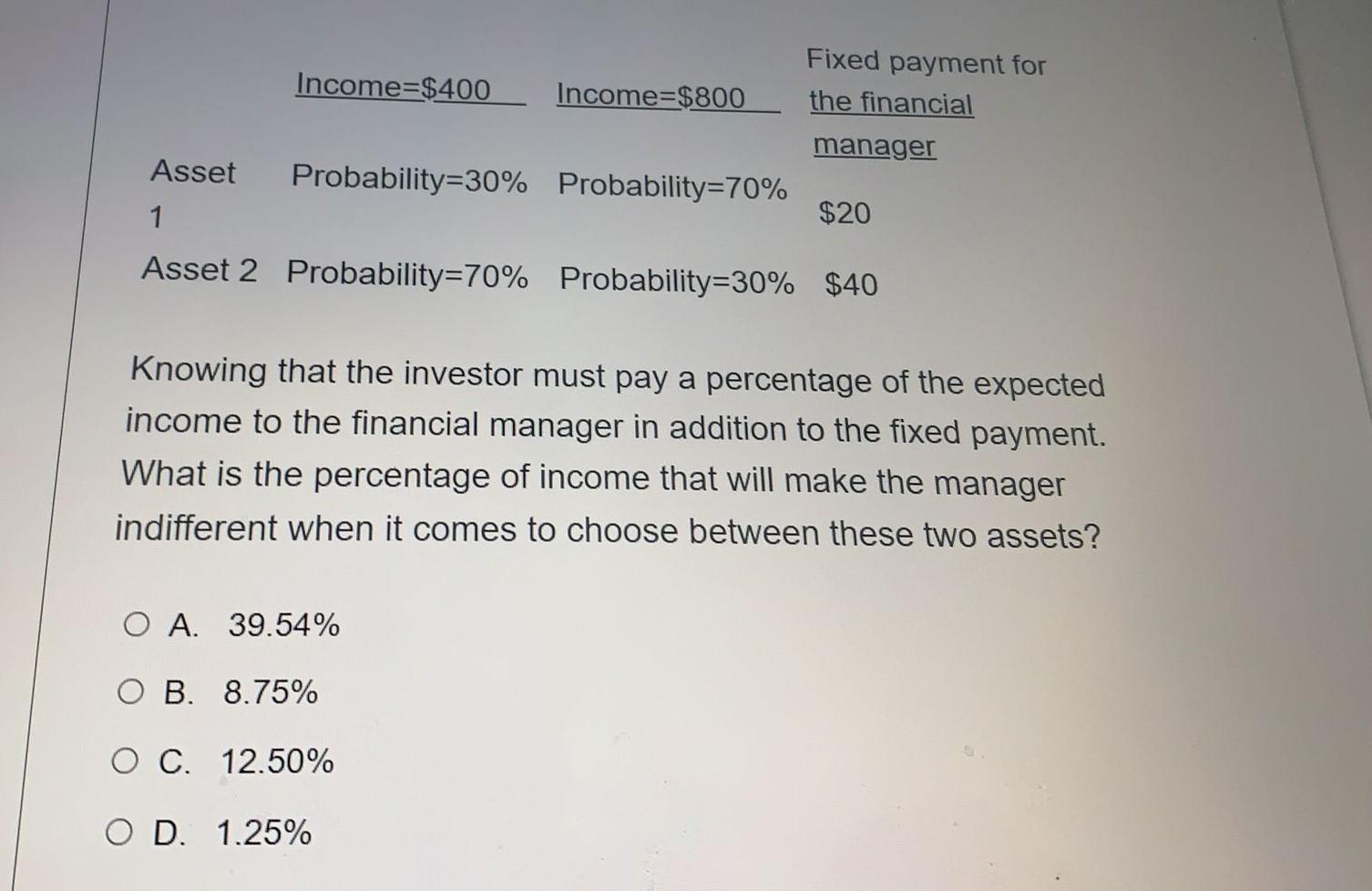

2 A financial manager has the choice between two risky assets to propose to an investor. The remuneration of this manager is composed of a fixed payment and a variable payment that depends on the expected income of each asset. Fixed payment for the financial Income=$400 Income=$800 manager Asset Probability=30% Probability=70% $20 1 Asset 2 Probability=70% Probability=30% $40 Knowing that the investor must pay a percentage of the expected income to the financial manager in addition to the fixed payment. What is the percentage of income that will make the manager indifferent when it comes to choose between these two assets? Fixed payment for Income=$400 Income=$800 the financial manager Probability=30% Probability=70% $20 Asset 1 Asset 2 Probability=70% Probability=30% $40 Knowing that the investor must pay a percentage of the expected income to the financial manager in addition to the fixed payment. What is the percentage of income that will make the manager indifferent when it comes to choose between these two assets? O A. 39.54% OB. 8.75% O C. 12.50% O D. 1.25%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts