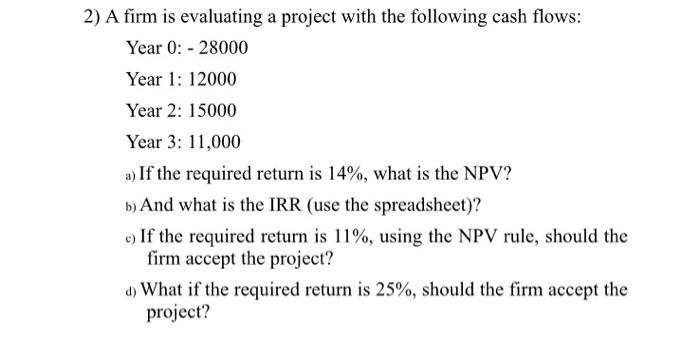

2) A firm is evaluating a project with the following cash flows: Year 0: - 28000...

Fantastic news! We've Found the answer you've been seeking!

Question:

Related Book For

Principles Of Taxation For Business And Investment Planning 2016 Edition

ISBN: 9781259549250

19th Edition

Authors: Sally Jones, Shelley Rhoades Catanach

Posted Date: