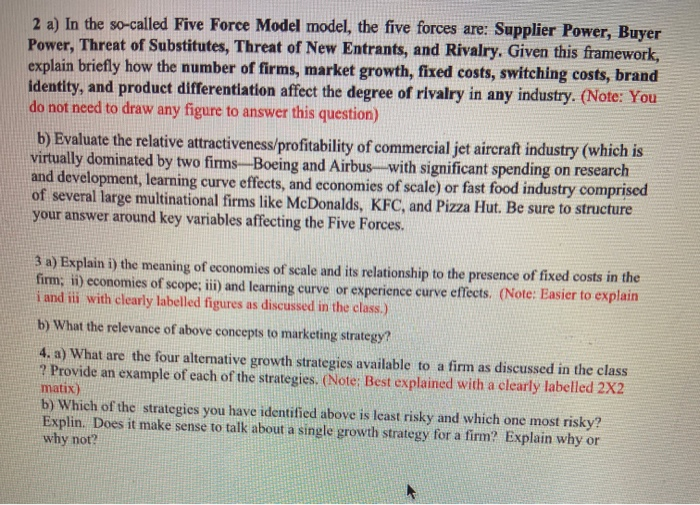

Question: 2 a) In the so-called Five Force Model model, the five forces are: Supplier Power, Buyer Power, Threat of Substitutes, Threat of New Entrants, and

2 a) In the so-called Five Force Model model, the five forces are: Supplier Power, Buyer Power, Threat of Substitutes, Threat of New Entrants, and Rivalry. Given this framework, explain briefly how the number of firms, market growth, fixed costs, switching costs, brand identity, and product differentiation affect the degree of rivalry in any industry. (Note: You do not need to draw any figure to answer this question) b) Evaluate the relative attractiveness/profitability of commercial jet aircraft industry (which is virtually dominated by two firms Boeing and Airbus with significant spending on research and development, learning curve effects, and economies of scale) or fast food industry comprised of several large multinational firms like McDonalds, KFC, and Pizza Hut. Be sure to structure your answer around key variables affecting the Five Forces. 3 a) Explain i) the meaning of economies of scale and its relationship to the presence of fixed costs in the firm; ii) economies of scope; iii) and learning curve or experience curve effects. (Note: Easier to explain i and ili with clearly labelled figures as discussed in the class.) b) What the relevance of above concepts to marketing strategy? 4. a) What are the four alternative growth strategies available to a firm as discussed in the class ? Provide an example of each of the strategies. (Note: Best explained with a clearly labelled 2X2 matix) b) Which of the strategies you have identified above is least risky and which one most risky? Explin. Does it make sense to talk about a single growth strategy for a firm? Explain why or why not? 2 a) In the so-called Five Force Model model, the five forces are: Supplier Power, Buyer Power, Threat of Substitutes, Threat of New Entrants, and Rivalry. Given this framework, explain briefly how the number of firms, market growth, fixed costs, switching costs, brand identity, and product differentiation affect the degree of rivalry in any industry. (Note: You do not need to draw any figure to answer this question) b) Evaluate the relative attractiveness/profitability of commercial jet aircraft industry (which is virtually dominated by two firms Boeing and Airbus with significant spending on research and development, learning curve effects, and economies of scale) or fast food industry comprised of several large multinational firms like McDonalds, KFC, and Pizza Hut. Be sure to structure your answer around key variables affecting the Five Forces. 3 a) Explain i) the meaning of economies of scale and its relationship to the presence of fixed costs in the firm; ii) economies of scope; iii) and learning curve or experience curve effects. (Note: Easier to explain i and ili with clearly labelled figures as discussed in the class.) b) What the relevance of above concepts to marketing strategy? 4. a) What are the four alternative growth strategies available to a firm as discussed in the class ? Provide an example of each of the strategies. (Note: Best explained with a clearly labelled 2X2 matix) b) Which of the strategies you have identified above is least risky and which one most risky? Explin. Does it make sense to talk about a single growth strategy for a firm? Explain why or why not