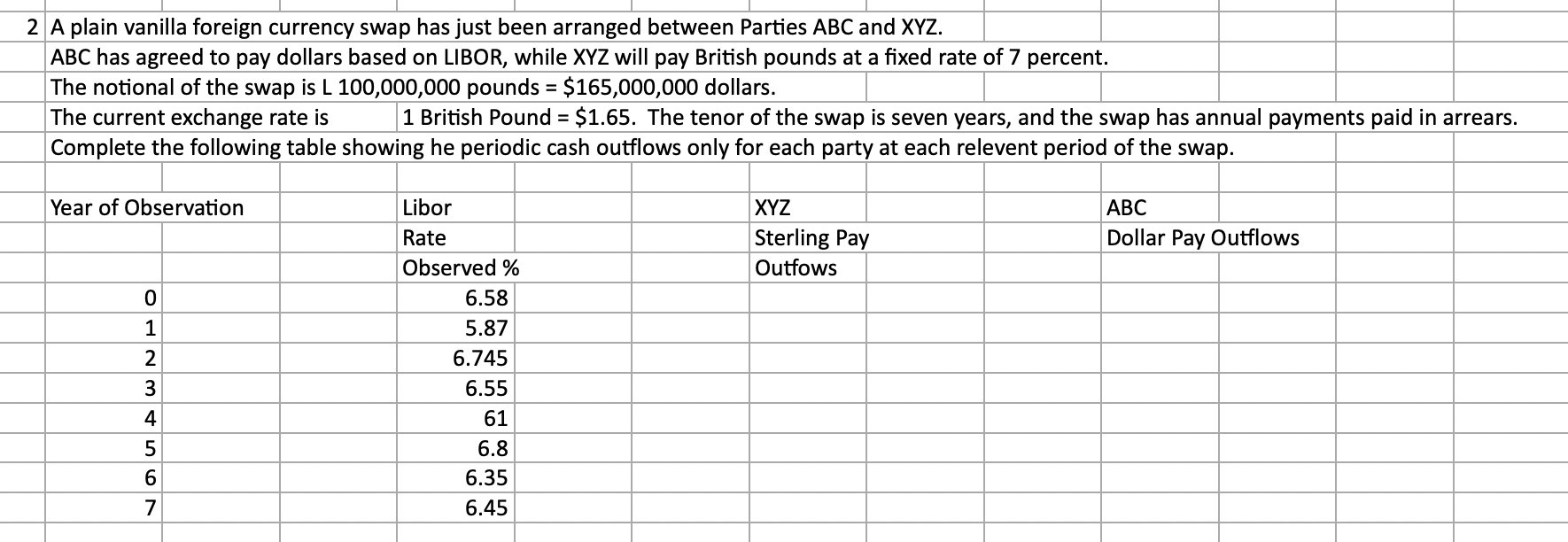

Question: 2 A plain vanilla foreign currency swap has just been arranged between Parties ABC and XYZ. ABC has agreed to pay dollars based on LIBOR,

2 A plain vanilla foreign currency swap has just been arranged between Parties ABC and XYZ. ABC has agreed to pay dollars based on LIBOR, while XYZ will pay British pounds at a fixed rate of 7 percent. The notional of the swap is L 100,000,000 pounds = $165,000,000 dollars. The current exchange rate is 1 British Pound = $1.65. The tenor of the swap is seven years, and the swap has annual payments paid in arrears. Complete the following table showing he periodic cash outflows only for each party at each relevent period of the swap. = Year of Observation XYZ Sterling Pay Outfows ABC Dollar Pay Outflows 0 1 2 3 On mon Libor Rate Observed % 6.58 5.87 6.745 6.55 61 6.8 6.35 6.45 4 5 6 7 2 A plain vanilla foreign currency swap has just been arranged between Parties ABC and XYZ. ABC has agreed to pay dollars based on LIBOR, while XYZ will pay British pounds at a fixed rate of 7 percent. The notional of the swap is L 100,000,000 pounds = $165,000,000 dollars. The current exchange rate is 1 British Pound = $1.65. The tenor of the swap is seven years, and the swap has annual payments paid in arrears. Complete the following table showing he periodic cash outflows only for each party at each relevent period of the swap. = Year of Observation XYZ Sterling Pay Outfows ABC Dollar Pay Outflows 0 1 2 3 On mon Libor Rate Observed % 6.58 5.87 6.745 6.55 61 6.8 6.35 6.45 4 5 6 7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts