Question: 2. A renovator bought a property for $200,000 using a 12 month loan with an annual rate of 4% with monthly compounding. Renovations cost an

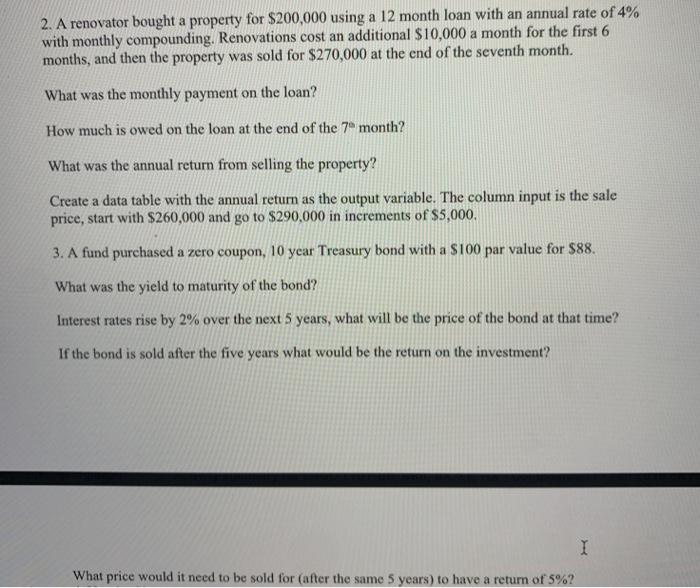

2. A renovator bought a property for $200,000 using a 12 month loan with an annual rate of 4% with monthly compounding. Renovations cost an additional $10,000 a month for the first 6 months, and then the property was sold for $270,000 at the end of the seventh month. What was the monthly payment on the loan? How much is owed on the loan at the end of the 7 month? What was the annual return from selling the property? Create a data table with the annual return as the output variable. The column input is the sale price, start with $260,000 and go to $290,000 in increments of $5,000, 3. A fund purchased a zero coupon, 10 year Treasury bond with a $100 par value for $88. What was the yield to maturity of the bond? Interest rates rise by 2% over the next 5 years, what will be the price of the bond at that time? If the bond is sold after the five years what would be the return on the investment? I What price would it need to be sold for (after the same 5 years) to have a return of 5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts