Question: 2. A trader is considering purchasing several Arrow-Debreu securities which all have the same maturity time, but provide a payoff of $1 at all possible

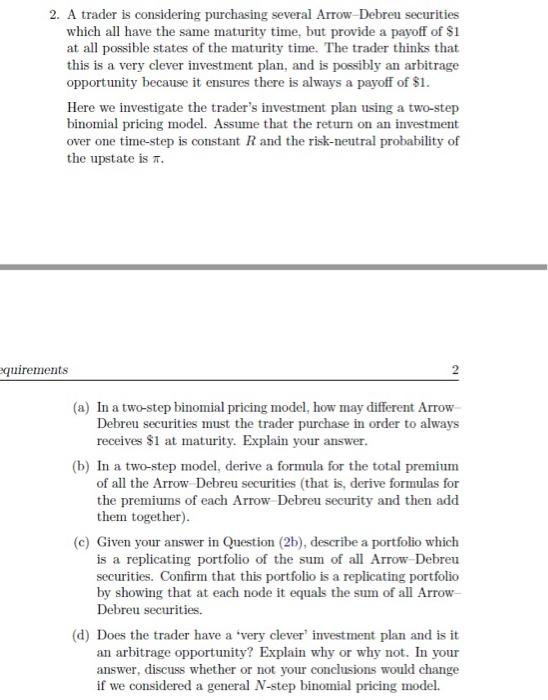

2. A trader is considering purchasing several Arrow-Debreu securities which all have the same maturity time, but provide a payoff of $1 at all possible states of the maturity time. The trader thinks that this is a very clever investment plan, and is possibly an arbitrage opportunity because it ensures there is always a payoff of $1. Here we investigate the trader's investment plan using a two-step binomial pricing model. Assume that the return on an investment over one time-step is constant R and the risk-neutral probability of the upstate is . (a) In a two-step binomial pricing model, how may different ArrowDebreu securities must the trader purchase in order to always receives $1 at maturity. Explain your answer. (b) In a two-step model, derive a formula for the total premium of all the Arrow-Debreu securities (that is, derive formulas for the premiums of each Arrow-Debreu security and then add them together). (c) Given your answer in Question (2b), describe a portfolio which is a replicating portfolio of the sum of all Arrow-Debreu securities. Confirm that this portfolio is a replicating portfolio by showing that at each node it equals the sum of all ArrowDebreu securities. (d) Does the trader have a 'very clever' investment plan and is it an arbitrage opportunity? Explain why or why not. In your answer, discuss whether or not your conclusions would change if we considered a general N-step binomial pricing model. 2. A trader is considering purchasing several Arrow-Debreu securities which all have the same maturity time, but provide a payoff of $1 at all possible states of the maturity time. The trader thinks that this is a very clever investment plan, and is possibly an arbitrage opportunity because it ensures there is always a payoff of $1. Here we investigate the trader's investment plan using a two-step binomial pricing model. Assume that the return on an investment over one time-step is constant R and the risk-neutral probability of the upstate is . (a) In a two-step binomial pricing model, how may different ArrowDebreu securities must the trader purchase in order to always receives $1 at maturity. Explain your answer. (b) In a two-step model, derive a formula for the total premium of all the Arrow-Debreu securities (that is, derive formulas for the premiums of each Arrow-Debreu security and then add them together). (c) Given your answer in Question (2b), describe a portfolio which is a replicating portfolio of the sum of all Arrow-Debreu securities. Confirm that this portfolio is a replicating portfolio by showing that at each node it equals the sum of all ArrowDebreu securities. (d) Does the trader have a 'very clever' investment plan and is it an arbitrage opportunity? Explain why or why not. In your answer, discuss whether or not your conclusions would change if we considered a general N-step binomial pricing model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts