Question: 2. A treasury bond with k2000 maturity value has K70 annual coupon and 10 years left to maturity. i. What price will the bond sell

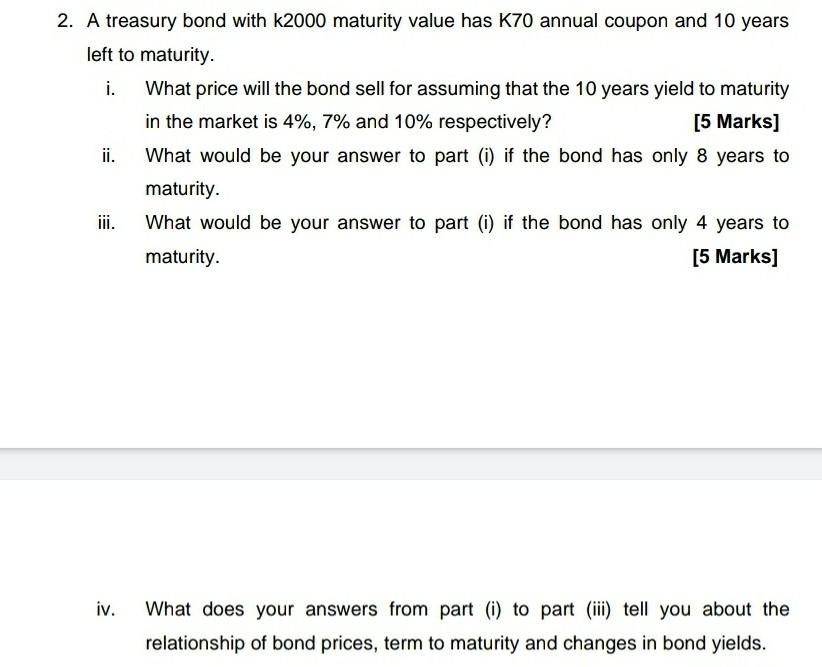

2. A treasury bond with k2000 maturity value has K70 annual coupon and 10 years left to maturity. i. What price will the bond sell for assuming that the 10 years yield to maturity in the market is 4%, 7% and 10% respectively? [5 Marks] ii. What would be your answer to part (i) if the bond has only 8 years to maturity. iii. What would be your answer to part (i) if the bond has only 4 years to maturity. [5 Marks] iv. What does your answers from part (i) to part (iii) tell you about the relationship of bond prices, term to maturity and changes in bond yields

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock