Question: 2. A. Your firm will have net cash flows equal to -$3 million if the yen is worth less than $.0078 in the market next

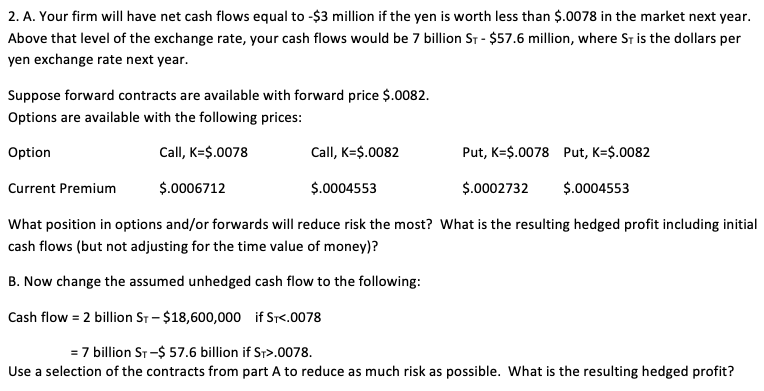

2. A. Your firm will have net cash flows equal to -$3 million if the yen is worth less than $.0078 in the market next year. Above that level of the exchange rate, your cash flows would be 7 billion ST - $57.6 million, where St is the dollars per yen exchange rate next year. Suppose forward contracts are available with forward price $.0082. Options are available with the following prices: Option Call, K=$.0078 Call, K=$.0082 Put, K=$.0078 Put, K=$.0082 Current Premium $.0006712 $.0004553 $.0002732 $.0004553 What position in options and/or forwards will reduce risk the most? What is the resulting hedged profit including initial cash flows (but not adjusting for the time value of money)? B. Now change the assumed unhedged cash flow to the following: Cash flow = 2 billion S1 - $18,600,000 if Sr<.0078 billion st- if st>.0078. Use a selection of the contracts from part A to reduce as much risk as possible. What is the resulting hedged profit? 2. A. Your firm will have net cash flows equal to -$3 million if the yen is worth less than $.0078 in the market next year. Above that level of the exchange rate, your cash flows would be 7 billion ST - $57.6 million, where St is the dollars per yen exchange rate next year. Suppose forward contracts are available with forward price $.0082. Options are available with the following prices: Option Call, K=$.0078 Call, K=$.0082 Put, K=$.0078 Put, K=$.0082 Current Premium $.0006712 $.0004553 $.0002732 $.0004553 What position in options and/or forwards will reduce risk the most? What is the resulting hedged profit including initial cash flows (but not adjusting for the time value of money)? B. Now change the assumed unhedged cash flow to the following: Cash flow = 2 billion S1 - $18,600,000 if Sr<.0078 billion st- if st>.0078. Use a selection of the contracts from part A to reduce as much risk as possible. What is the resulting hedged profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts