Question: ( 2 . ) A zero - coupon bond promises to pay $ 1 , 0 0 0 in principal 1 5 years from now.

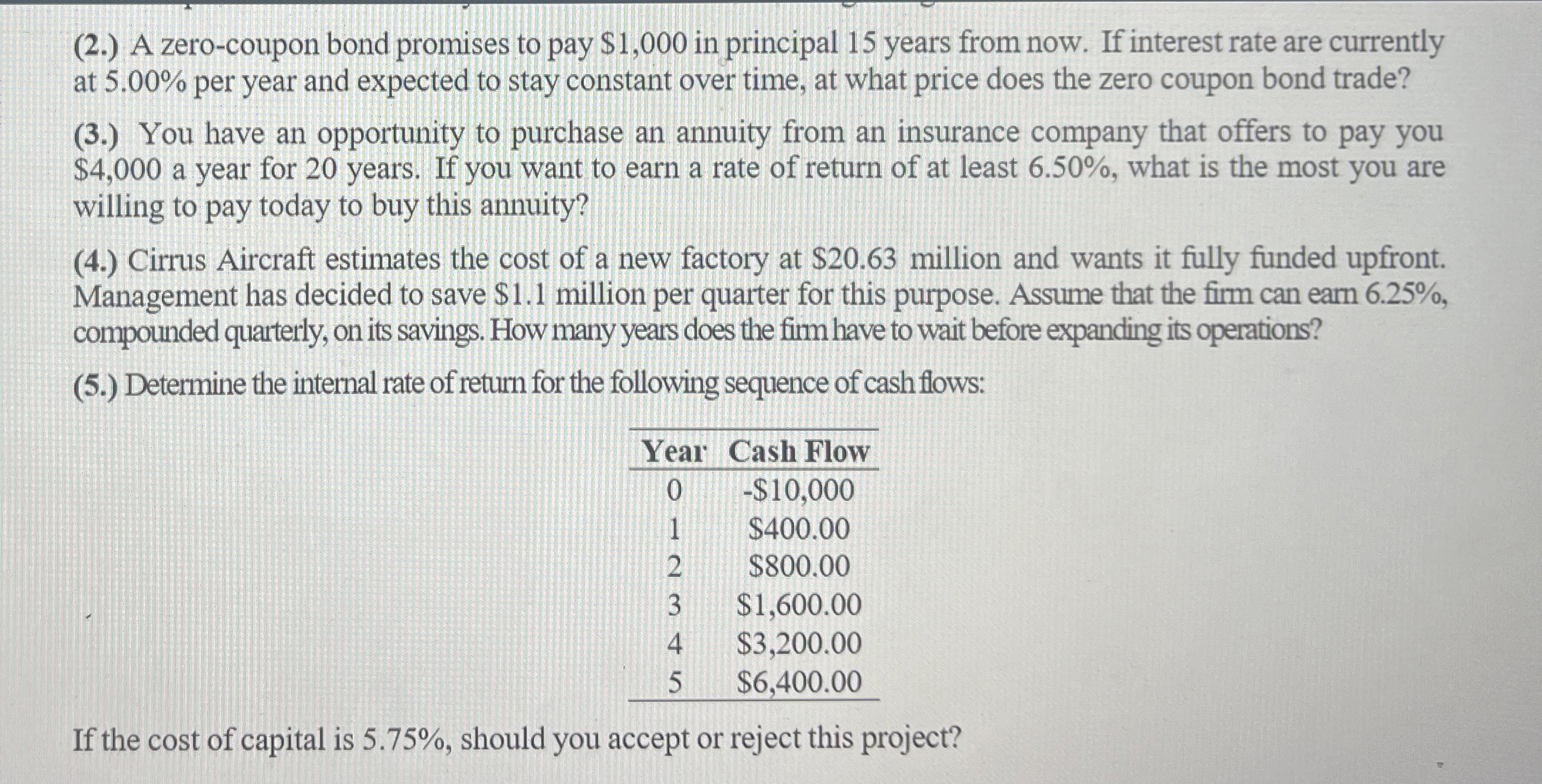

A zerocoupon bond promises to pay $ in principal years from now. If interest rate are currently at per year and expected to stay constant over time, at what price does the zero coupon bond trade?

You have an opportunity to purchase an annuity from an insurance company that offers to pay you $ a year for years. If you want to earn a rate of return of at least what is the most you are willing to pay today to buy this annuity?

Cirrus Aircraft estimates the cost of a new factory at $ million and wants it fully funded upfront. Management has decided to save $ million per quarter for this purpose. Assume that the firm can earn compounded quarterly, on its savings. How many years does the firm have to wait before expanding its operations?

Determine the internal rate of return for the following sequence of cash flows:

tableYearCash Flow$

Solve all questions

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock