Question: 2 AaBbCcDdEe AaBbCcDdEe V Normal No Spacing Section B - Answer any three questions Question 1 The expected returns and standard deviations of L'Oreal and

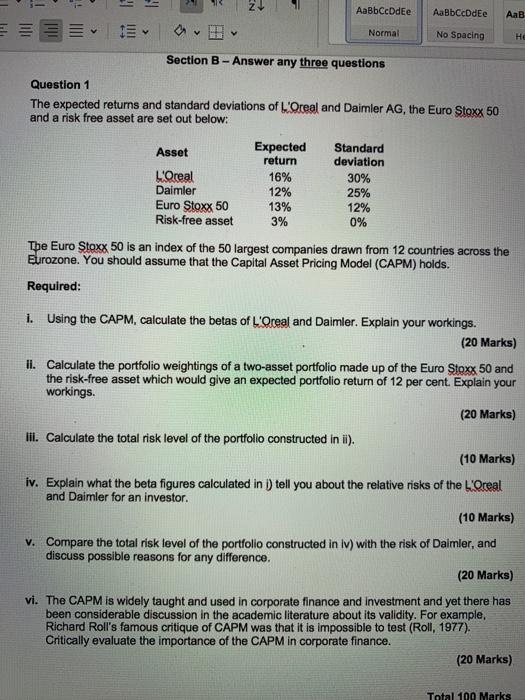

2 AaBbCcDdEe AaBbCcDdEe V Normal No Spacing Section B - Answer any three questions Question 1 The expected returns and standard deviations of L'Oreal and Daimler AG, the Euro Stoxx 50 and a risk free asset are set out below: Asset Expected Standard return deviation L'Oreal 16% 30% Daimler 12% 25% Euro Stoxx 50 13% 12% Risk-free asset 3% 0% The Euro Stoxx 50 is an index of the 50 largest companies drawn from 12 countries across the Eurozone. You should assume that the Capital Asset Pricing Model (CAPM) holds. Required: 1. Using the CAPM, calculate the betas of L'Oreal and Daimler. Explain your workings. (20 Marks) ii. Calculate the portfolio weightings of a two-asset portfolio made up of the Euro Stoxx 50 and the risk-free asset which would give an expected portfolio return of 12 per cent. Explain your workings. (20 Marks) lil. Calculate the total risk level of the portfolio constructed in ii). (10 Marks) iv. Explain what the beta figures calculated in ) tell you about the relative risks of the L'Oreal and Daimler for an investor. (10 Marks) V. Compare the total risk level of the portfolio constructed in iv) with the risk of Daimler, and discuss possible reasons for any difference. (20 Marks) vi. The CAPM is widely taught and used in corporate finance and investment and yet there has been considerable discussion in the academic literature about its validity. For example, Richard Roll's famous critique of CAPM was that it is impossible to test (Roll, 1977). Critically evaluate the importance of the CAPM in corporate finance. (20 Marks) Total 100 Marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts