Question: 2 . ABC Company has subsidiaries in Countries ( X , Y ) , and ( Z ) . Each manufactures

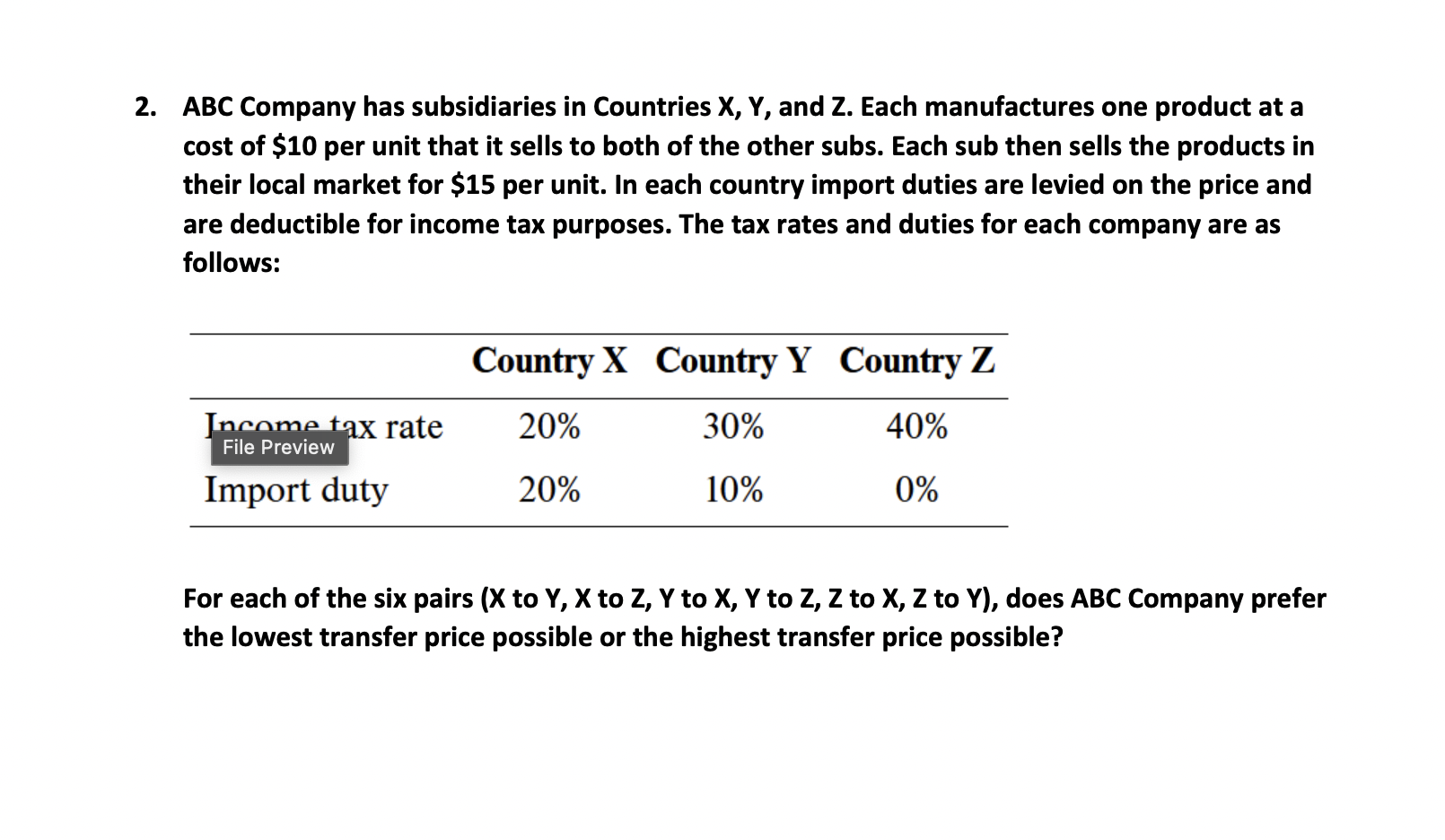

ABC Company has subsidiaries in Countries X Y and Z Each manufactures one product at a cost of mathbf$ per unit that it sells to both of the other subs. Each sub then sells the products in their local market for $ per unit. In each country import duties are levied on the price and are deductible for income tax purposes. The tax rates and duties for each company are as follows: For each of the six pairs mathbfX to mathbfYmathbfX to mathbfZmathbfY to mathbfXmathbfY to mathbfZmathbfZ to mathbfXmathbfZ to Y does ABC Company prefer the lowest transfer price possible or the highest transfer price possible?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock