Question: 2. ADC has an outstanding bond issue that has a face value of $100.00 and yield of 8.42%. This bond pays a semi-annual coupon of

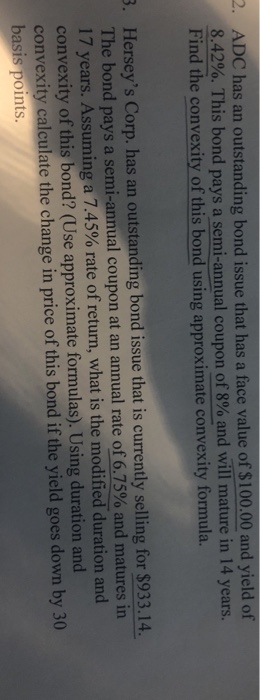

2. ADC has an outstanding bond issue that has a face value of $100.00 and yield of 8.42%. This bond pays a semi-annual coupon of 8% and will mature in 14 years Find the convexity of this bond using approximate convexity formula. Hersey's Corp. has an outstanding bond issue that is currently selling for $933.14 The bond pays a semi-annual coupon at an annual rate of 6.75% and matures in 17 years. Assuming a 7.45% rate of return, what is the modified duration and convexity of this bond? (Use approximate formulas). Using duration and convexity calculate the change in price of this bond if the yield goes down by 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts