Question: 2 . Adding growth to the model Markum Co . has a value of $ 8 0 million. Carter is otherwise identical to Markum Co

Adding growth to the model

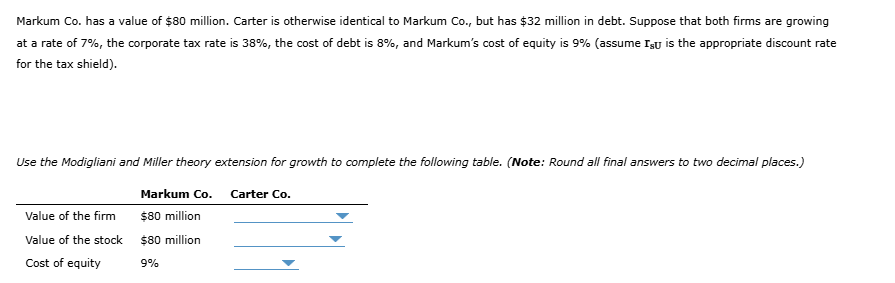

Markum Co has a value of $ million. Carter is otherwise identical to Markum Co but has $ million in debt. Suppose that both firms are growing at a rate of the corporate tax rate is the cost of debt is and Markums cost of equity is assume rsUrsUis the appropriate discount rate for the tax shield

Use the Modigliani and Miller theory extension for growth to complete the following table. Note: Round all final answers to two decimal places.

Markum Co

Carter Co

Value of the firm$ millionValue of the stock$ millionCost of equity Markum Co has a value of $ million. Carter is otherwise identical to Markum Co but has $ million in debt. Suppose that both firms are growing at a rate of the corporate tax rate is the cost of debt is and Markum's cost of equity is assume mathbfrmathbfs U is the appropriate discount rate for the tax shield

Use the Modigliani and Miller theory extension for growth to complete the following table. Note: Round all final answers to two decimal places.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock