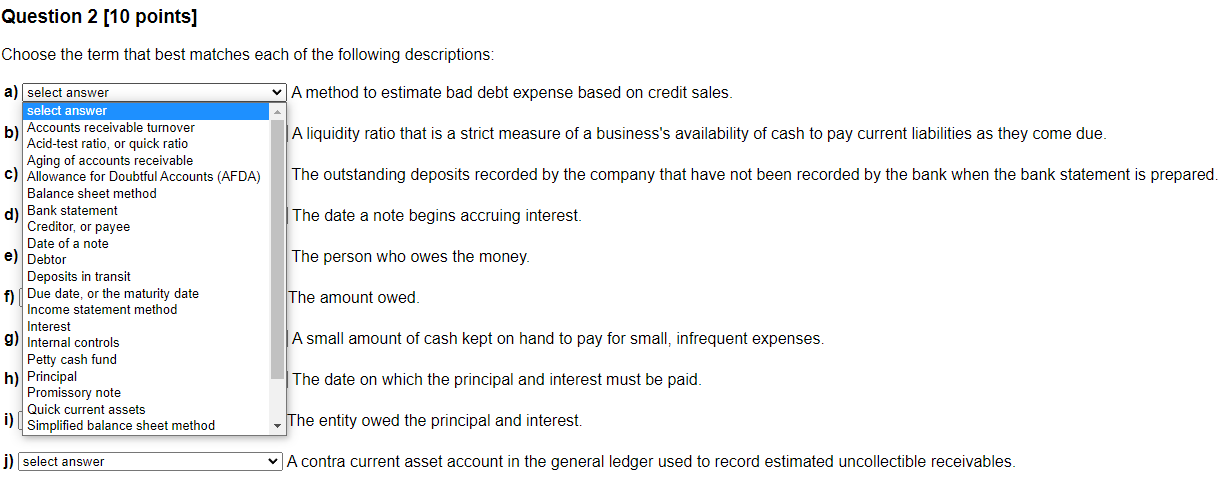

Question: 2 additional choice Uncollectable accts or bad debts write-off Question 2 [10 points] Choose the term that best matches each of the following descriptions: A

2 additional choice

Uncollectable accts or bad debts

write-off

Question 2 [10 points] Choose the term that best matches each of the following descriptions: A method to estimate bad debt expense based on credit sales | A liquidity ratio that is a strict measure of a business's availability of cash to pay current liabilities as they come due. The outstanding deposits recorded by the company that have not been recorded by the bank when the bank statement is prepared. The date a note begins accruing interest. a) select answer select answer b) Accounts receivable turnover Acid-test ratio, or quick ratio Aging of accounts receivable c) Allowance for Doubtful Accounts (AFDA) Balance sheet method Bank statement d) Creditor, or payee Date of a note e) Debtor Deposits in transit Due date, or the maturity date Income statement method Interest g) Internal controls Petty cash fund h) Principal Promissory note Quick current assets i) Simplified balance sheet method The person who owes the money The amount owed. |A small amount of cash kept on hand to pay for small, infrequent expenses. The date on which the principal and interest must be paid. The entity owed the principal and interest. j) select answer A contra current asset account in the general ledger used to record estimated uncollectible receivables

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts