Question: 2. Adjusted EBITDA takes EBITDA and offers additional adjustments, such as an adjustment for Stock Based Compensation. What is conceptual or informational value goal of

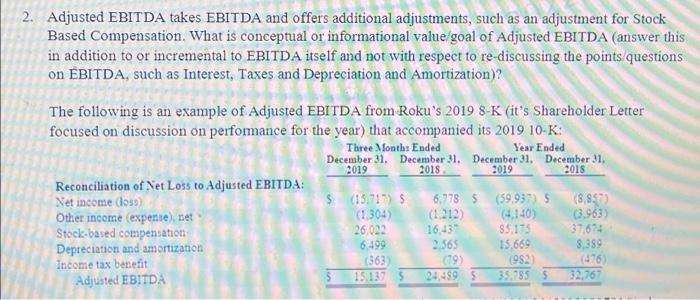

2. Adjusted EBITDA takes EBITDA and offers additional adjustments, such as an adjustment for Stock Based Compensation. What is conceptual or informational value goal of Adjusted EBITDA (answer this in addition to or incremental to EBITDA itself and not with respect to re-discussing the points questions on EBITDA, such as Interest, Taxes and Depreciation and Amortization)? The following is an example of Adjusted EBITDA from Roku's 2019 8-K (it's Shareholder Letter focused on discussion on performance for the year) that accompanied its 2019 10-K: Three Months Ended Year Ended December 31. December 31. December 31. December 31. Reconciliation of Net Loss to Adjusted EBITDA: Net income (103) $(15.71 $ 6,978 5 (59.93) $ (8,8593 Other income expense), net (1.304) (1212) (4,140) (3,963) Stock-based compensation 26,022 16.43 85113 37674 Depreciation and amortization 6.499 2.565 15.669 8.389 Income tax beneint (363) 019 (982 (476) Adjusted EBITDA 15.1375 24,4895 35.785 32,767 2019 2015 2019 2015

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts