Question: 2 . An investor is planning to execute a margin transaction for two years with Security A , where the initial margin is 4 0

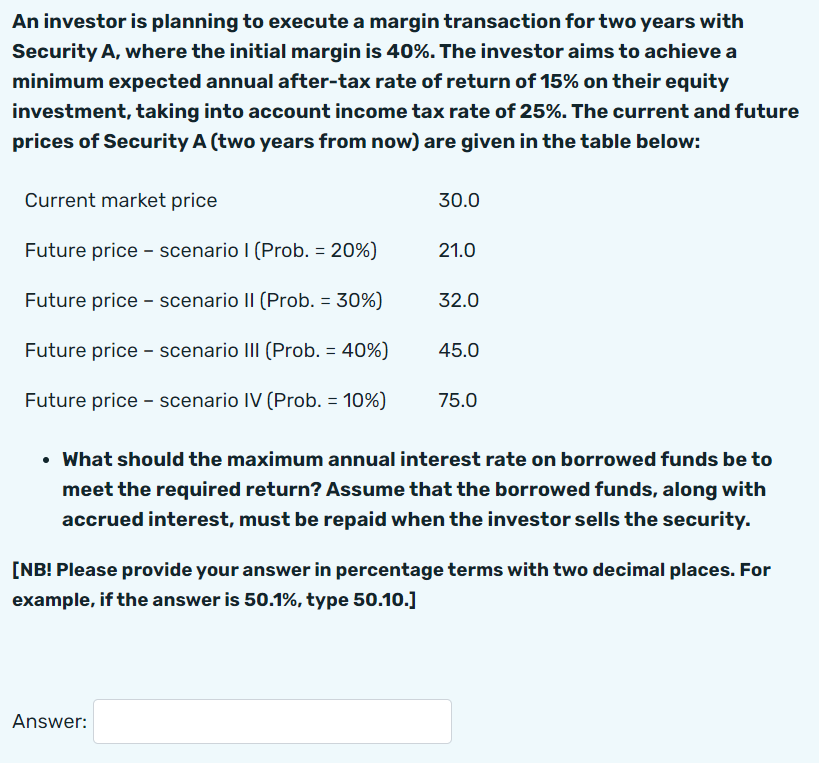

An investor is planning to execute a margin transaction for two years with Security A where the initial margin is The investor aims to achieve a minimum expected annual aftertax rate of return of on their equity investment, taking into account income tax rate of The current and future prices of Security A two years from now are given in the table below:

Current market price

Future price scenario I Prob

Future price scenario II Prob

Future price scenario III Prob

Future price scenario IV Prob

What should the maximum annual interest rate on borrowed funds be to meet the required return? Assume that the borrowed funds, along with accrued interest, must be repaid wher the investor sells the security. NB Please provide your answer in percentage terms with two decimal places. For example, if the answer is type An investor is planning to execute a margin transaction for two years with

Security A where the initial margin is The investor aims to achieve a

minimum expected annual aftertax rate of return of on their equity

investment, taking into account income tax rate of The current and future

prices of Security A two years from now are given in the table below:

What should the maximum annual interest rate on borrowed funds be to

meet the required return? Assume that the borrowed funds, along with

accrued interest, must be repaid when the investor sells the security.

NB Please provide your answer in percentage terms with two decimal places. For

example, if the answer is type

Answer:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock