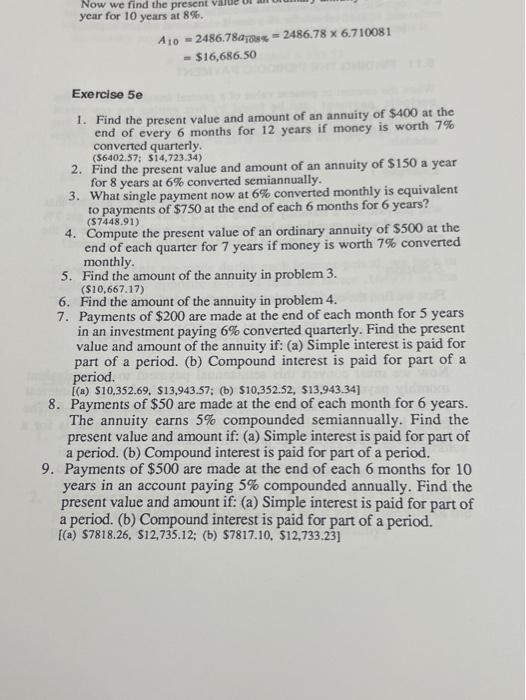

Question: #2 and #4 Now we find the present Value year for 10 years at 8%. A10 = 2486.78aass=2486.78 x 6.710081 - $16,686,50 Exercise 5e 1.

Now we find the present Value year for 10 years at 8%. A10 = 2486.78aass=2486.78 x 6.710081 - $16,686,50 Exercise 5e 1. Find the present value and amount of an annuity of $400 at the end of every 6 months for 12 years if money is worth 7% converted quarterly (56402.57: $14,723.34) 2. Find the present value and amount of an annuity of $150 a year for 8 years at 6% converted semiannually. 3. What single payment now at 6% converted monthly is equivalent to payments of $750 at the end of each 6 months for 6 years? (57448.91) 4. Compute the present value of an ordinary annuity of $500 at the end of each quarter for 7 years if money is worth 7% converted monthly. 5. Find the amount of the annuity in problem 3. ($10,667.17) 6. Find the amount of the annuity in problem 4. 7. Payments of $200 are made at the end of each month for 5 years in an investment paying 6% converted quarterly. Find the present value and amount of the annuity if: (a) Simple interest is paid for part of a period. (b) Compound interest is paid for part of a period. (a) $10,352.69, $13,943.57; (b) $10,352.52, 513.943.34] 8. Payments of $50 are made at the end of each month for 6 years. The annuity earns 5% compounded semiannually. Find the present value and amount if: (a) Simple interest is paid for part of a period. (b) Compound interest is paid for part of a period. 9. Payments of $500 are made at the end of each 6 months for 10 years in an account paying 5% compounded annually. Find the present value and amount if: (a) Simple interest is paid for part of a period. (b) Compound interest is paid for part of a period. (a) $7818.26, S12,735.12; (b) $7817.10, $12,733.23]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts