Question: 2. Another company is considering installing a new machine. The Machine initially costs $900,000, but the company could recoup $100,000 through an incentive from the

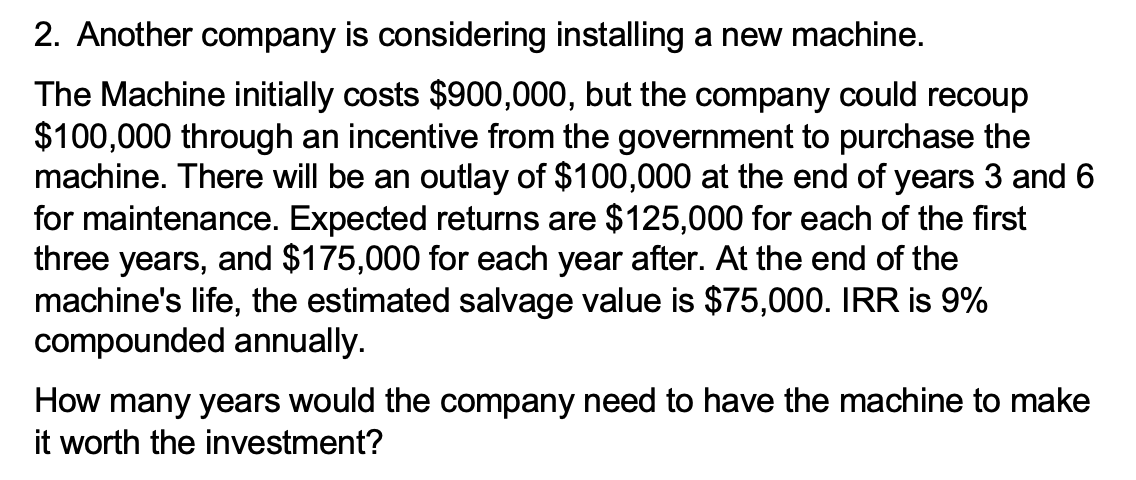

2. Another company is considering installing a new machine. The Machine initially costs $900,000, but the company could recoup $100,000 through an incentive from the government to purchase the machine. There will be an outlay of $100,000 at the end of years 3 and 6 for maintenance. Expected returns are $125,000 for each of the first three years, and $175,000 for each year after. At the end of the machine's life, the estimated salvage value is $75,000. IRR is 9% compounded annually. How many years would the company need to have the machine to make it worth the investment? 2. Another company is considering installing a new machine. The Machine initially costs $900,000, but the company could recoup $100,000 through an incentive from the government to purchase the machine. There will be an outlay of $100,000 at the end of years 3 and 6 for maintenance. Expected returns are $125,000 for each of the first three years, and $175,000 for each year after. At the end of the machine's life, the estimated salvage value is $75,000. IRR is 9% compounded annually. How many years would the company need to have the machine to make it worth the investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts