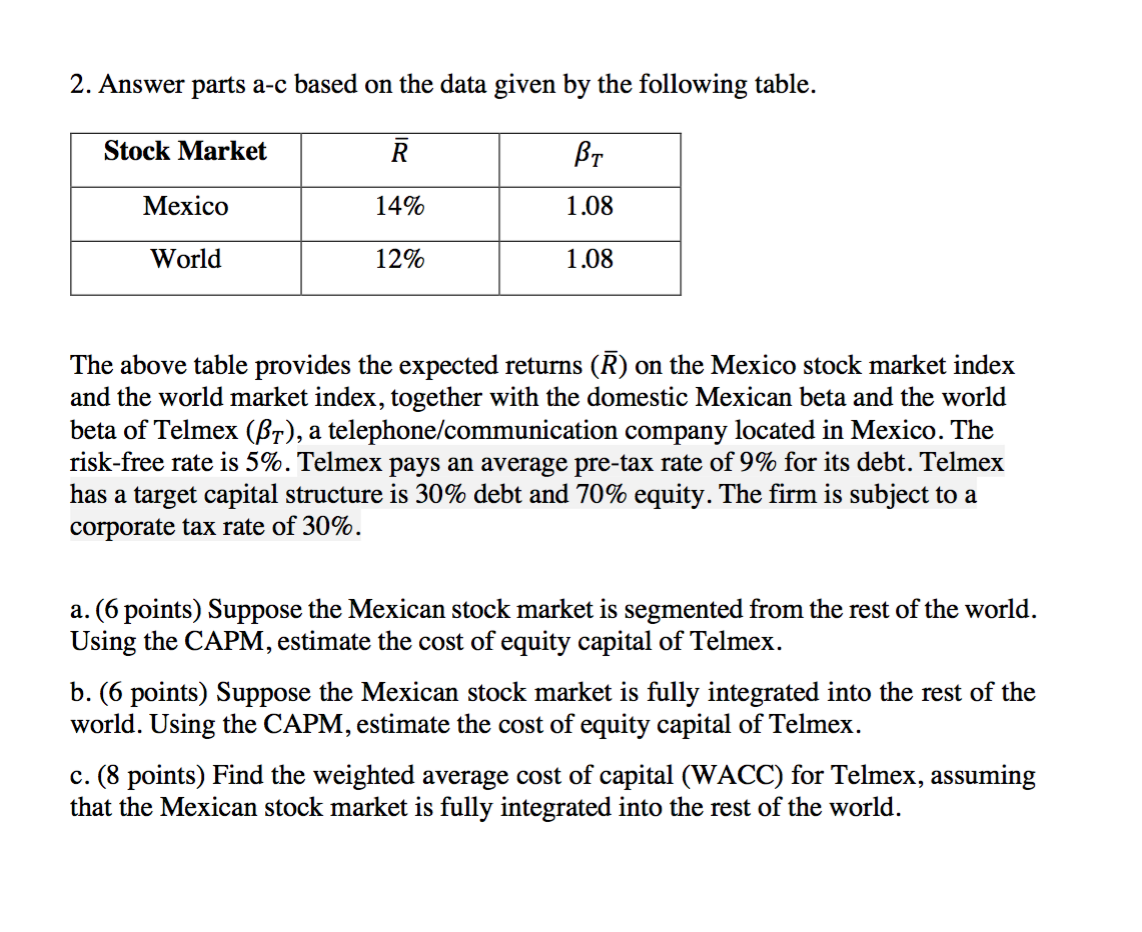

Question: 2. Answer parts a-c based on the data given by the following table. Stock Market Mexico 14% 1.08 World 12% 1.08 The above table provides

2. Answer parts a-c based on the data given by the following table. Stock Market Mexico 14% 1.08 World 12% 1.08 The above table provides the expected returns () on the Mexico stock market index and the world market index, together with the domestic Mexican beta and the world beta of Telmex (BT), a telephone/communication company located in Mexico. The risk-free rate is 5%. Telmex pays an average pre-tax rate of 9% for its debt. Telmex has a target capital structure is 30% debt and 70% equity. The firm is subject to a corporate tax rate of 30%. a. (6 points) Suppose the Mexican stock market is segmented from the rest of the world. Using the CAPM, estimate the cost of equity capital of Telmex. b. (6 points) Suppose the Mexican stock market is fully integrated into the rest of the world. Using the CAPM, estimate the cost of equity capital of Telmex. c. (8 points) Find the weighted average cost of capital (WACC) for Telmex, assuming that the Mexican stock market is fully integrated into the rest of the world

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts