Question: 2. Answer the following questions by using the Gordon Growth Model for stock price valuation. Show your work a. If General Motors is currently paying

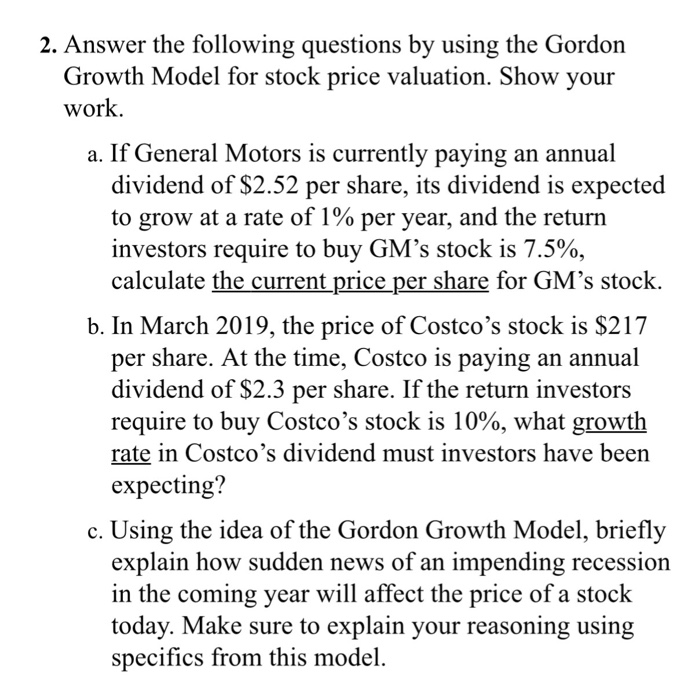

2. Answer the following questions by using the Gordon Growth Model for stock price valuation. Show your work a. If General Motors is currently paying an annual dividend of $2.52 per share, its dividend is expected to grow at a rate of 1% per year, and the return investors require to buy GM's stock is 7.5%. calculate the current price per share for GM's stock. b. In March 2019, the price of Costco's stock is $217 per share. At the time, Costco is paying an annual dividend of S2.3 per share. If the return investors require to buy Costco's stock is 10%, what growth rate in Costco's dividend must investors have been expecting? c. Using the idea of the Gordon Growth Model, briefly explain how sudden news of an impending recession in the coming year will affect the price of a stock today. Make sure to explain your reasoning using specifics from this model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts