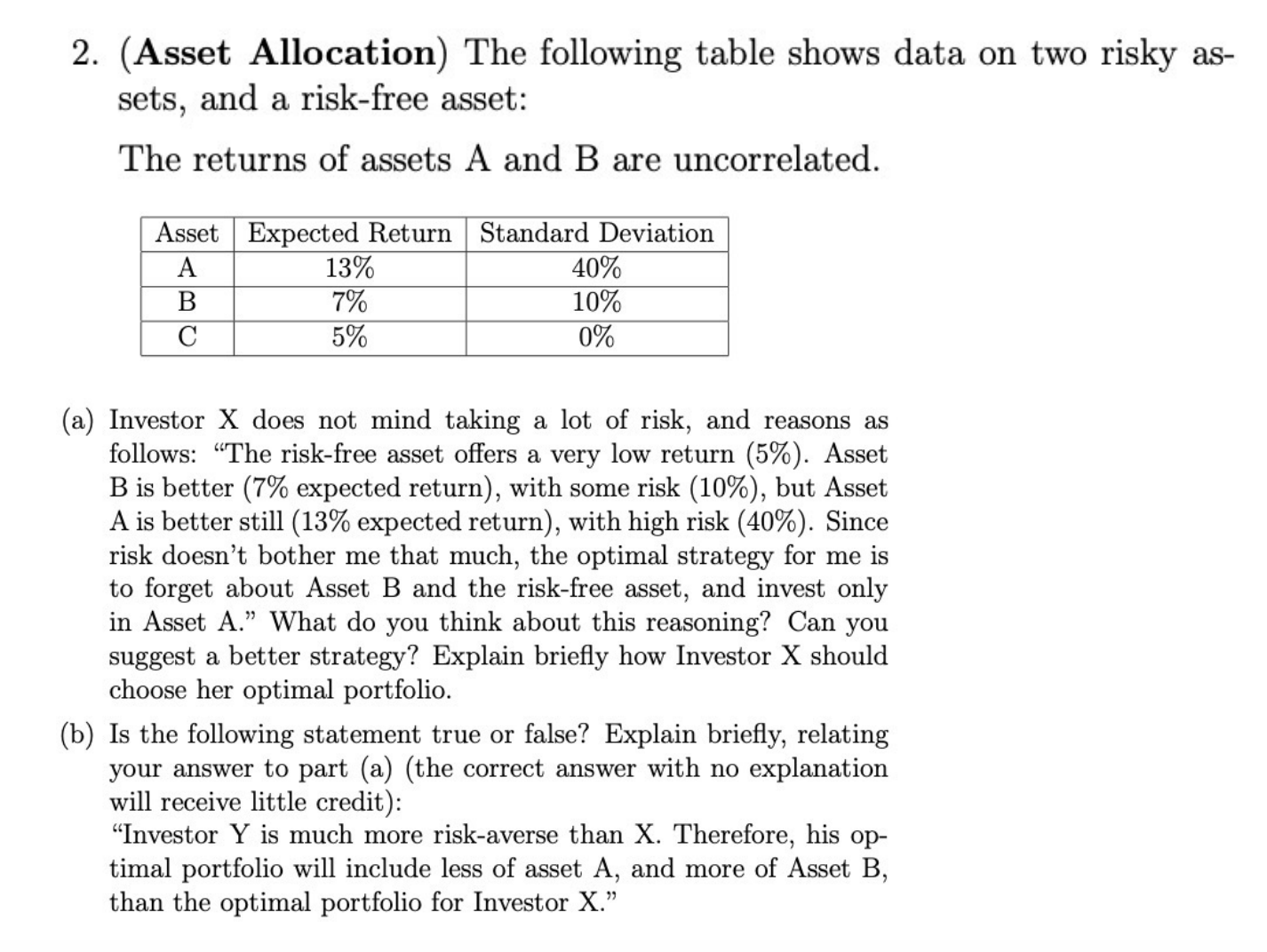

Question: 2. (Asset Allocation) The following table shows data on two risky assets, and a risk-free asset: The returns of assets A and B are uncorrelated.

2. (Asset Allocation) The following table shows data on two risky assets, and a risk-free asset: The returns of assets A and B are uncorrelated. (a) Investor X does not mind taking a lot of risk, and reasons as follows: "The risk-free asset offers a very low return (5\%). Asset B is better ( 7% expected return), with some risk (10\%), but Asset A is better still ( 13% expected return), with high risk (40\%). Since risk doesn't bother me that much, the optimal strategy for me is to forget about Asset B and the risk-free asset, and invest only in Asset A." What do you think about this reasoning? Can you suggest a better strategy? Explain briefly how Investor X should choose her optimal portfolio. (b) Is the following statement true or false? Explain briefly, relating your answer to part (a) (the correct answer with no explanation will receive little credit): "Investor Y is much more risk-averse than X. Therefore, his optimal portfolio will include less of asset A, and more of Asset B, than the optimal portfolio for Investor X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts