Question: 2 Assume depreciation has been recorded based on machine usage as calculated above. The machine is obsolete at the end of three years and is

| 2 | Assume depreciation has been recorded based on machine usage as calculated above. The machine is obsolete at the end of three years and is sold on January 10, 2022 for $3,000. Calculate the gain or loss on disposal and show the journal entry. | ||||||

| Date | Journal | Debit | Credit | ||||

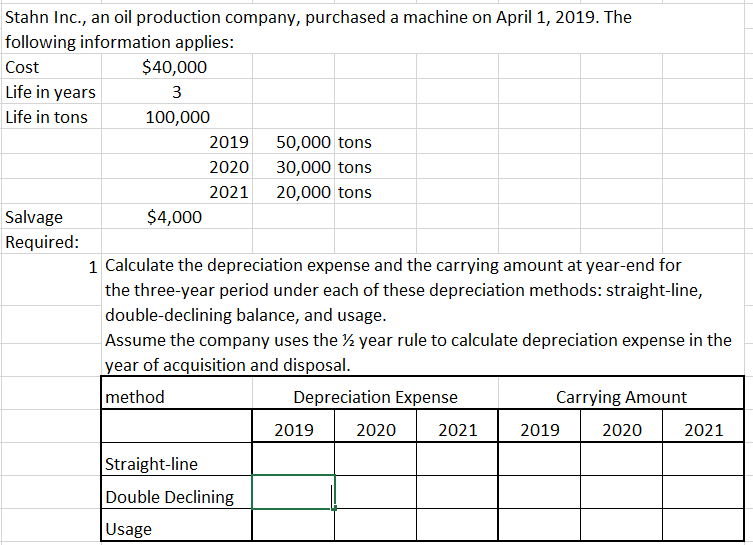

Stahn Inc., an oil production company, purchased a machine on April 1, 2019. The following information applies: Cost $40,000 Life in years 3 Life in tons 100,000 2019 50,000 tons 2020 30,000 tons 2021 20,000 tons Salvage $4,000 Required: 1 Calculate the depreciation expense and the carrying amount at year-end for the three-year period under each of these depreciation methods: straight-line, double-declining balance, and usage. Assume the company uses the / year rule to calculate depreciation expense in the year of acquisition and disposal. method Depreciation Expense Carrying Amount 2019 2020 2021 2019 2020 2021 Straight-line Double Declining Usage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts