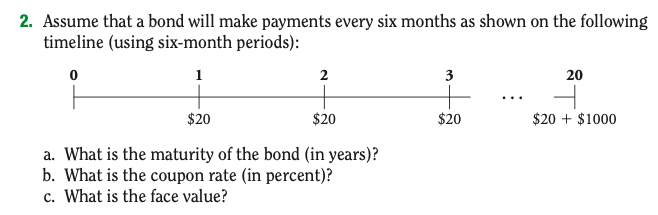

Question: 2. Assume that a bond will make payments every six months as shown on the following timeline (using six-month periods): 0 1 2 3 20

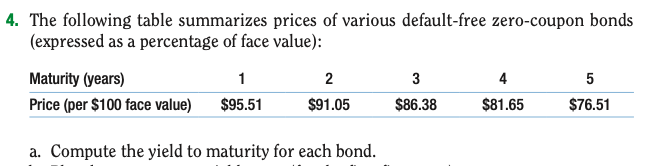

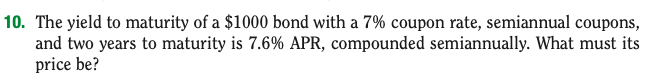

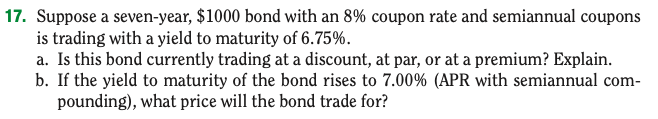

2. Assume that a bond will make payments every six months as shown on the following timeline (using six-month periods): 0 1 2 3 20 $20 $20 $20 $20 + $1000 a. What is the maturity of the bond (in years)? b. What is the coupon rate (in percent)? c. What is the face value? 4. The following table summarizes prices of various default-free zero-coupon bonds (expressed as a percentage of face value): Maturity (years) 1 2 3 4 5 Price (per $100 face value) $95.51 $91.05 $86.38 $81.65 $76.51 a. Compute the yield to maturity for each bond. 10. The yield to maturity of a $1000 bond with a 7% coupon rate, semiannual coupons, and two years to maturity is 7.6% APR, compounded semiannually. What must its price be? 17. Suppose a seven-year, $1000 bond with an 8% coupon rate and semiannual coupons is trading with a yield to maturity of 6.75%. a. Is this bond currently trading at a discount, at par, or at a premium? Explain. b. If the yield to maturity of the bond rises to 7.00% (APR with semiannual com- pounding), what price will the bond trade for

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts