Question: (2 ) Assume that Adams, Block & Smith, having formed Manufacturing Corp. on February 1, 2019, and having received the ownership interest set out in

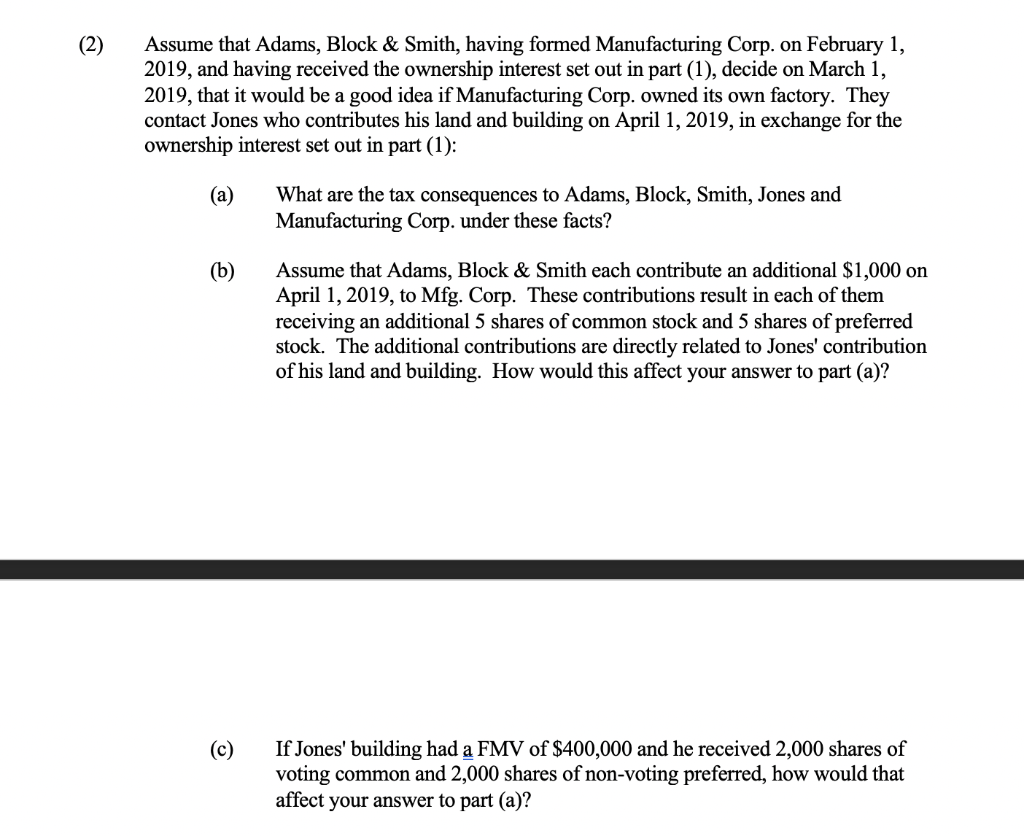

(2 ) Assume that Adams, Block & Smith, having formed Manufacturing Corp. on February 1, 2019, and having received the ownership interest set out in part (1), decide on March 1, 2019, that it would be a good idea if Manufacturing Corp. owned its own factory. They contact Jones who contributes his land and building on April 1, 2019, in exchange for the ownership interest set out in part (1): (a) What are the tax consequences to Adams, Block, Smith, Jones and Manufacturing Corp. under these facts? (b) Assume that Adams, Block & Smith each contribute an additional $1,000 on April 1, 2019, to Mfg. Corp. These contributions result in each of them receiving an additional 5 shares of common stock and 5 shares of preferred stock. The additional contributions are directly related to Jones' contribution of his land and building. How would this affect your answer to part (a)? (c) If Jones' building had a FMV of $400,000 and he received 2,000 shares of voting common and 2,000 shares of non-voting preferred, how would that affect your answer to part (a)? (2 ) Assume that Adams, Block & Smith, having formed Manufacturing Corp. on February 1, 2019, and having received the ownership interest set out in part (1), decide on March 1, 2019, that it would be a good idea if Manufacturing Corp. owned its own factory. They contact Jones who contributes his land and building on April 1, 2019, in exchange for the ownership interest set out in part (1): (a) What are the tax consequences to Adams, Block, Smith, Jones and Manufacturing Corp. under these facts? (b) Assume that Adams, Block & Smith each contribute an additional $1,000 on April 1, 2019, to Mfg. Corp. These contributions result in each of them receiving an additional 5 shares of common stock and 5 shares of preferred stock. The additional contributions are directly related to Jones' contribution of his land and building. How would this affect your answer to part (a)? (c) If Jones' building had a FMV of $400,000 and he received 2,000 shares of voting common and 2,000 shares of non-voting preferred, how would that affect your answer to part (a)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts