Question: 2. Assume that the current date is 30 September 2020 Gilet plc (Gilet), a UK company, exports pharmaceuticals to the Canadian health service and receives

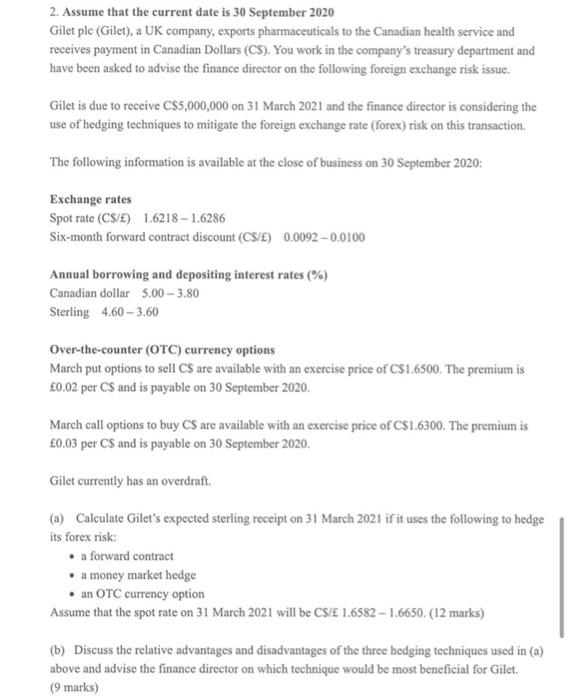

2. Assume that the current date is 30 September 2020 Gilet plc (Gilet), a UK company, exports pharmaceuticals to the Canadian health service and receives payment in Canadian Dollars (CS). You work in the company's treasury department and have been asked to advise the finance director on the following foreign exchange risk issue. Gilet is due to receive C$5,000,000 on 31 March 2021 and the finance director is considering the use of hedging techniques to mitigate the foreign exchange rate (forex) risk on this transaction. The following information is available at the close of business on 30 September 2020: Exchange rates Spot rate (CS/E) 1.6218-1.6286 Six-month forward contract discount (CS/E) 0.0092-0.0100 Annual borrowing and depositing interest rates (%) Canadian dollar 5.00-3.80 Sterling 4.60-3.60 Over-the-counter (OTC) currency options March put options to sell CS are available with an exercise price of C$1.6500. The premium is 0.02 per CS and is payable on 30 September 2020. March call options to buy CS are available with an exercise price of CS1.6300. The premium is 0.03 per CS and is payable on 30 September 2020. Gilet currently has an overdraft. (a) Calculate Gilet's expected sterling receipt on 31 March 2021 if it uses the following to hedge its forex risk: a forward contract a money market hedge an OTC currency option Assume that the spot rate on 31 March 2021 will be CS/E 1.6582-1.6650. (12 marks) (b) Discuss the relative advantages and disadvantages of the three hedging techniques used in (a) above and advise the finance director on which technique would be most beneficial for Gilet. (9 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts