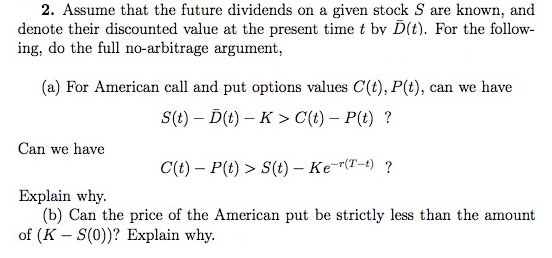

Question: 2. Assume that the future dividends on a given stock S are known, and denote their discounted value at the present time t bv D(t).

2. Assume that the future dividends on a given stock S are known, and denote their discounted value at the present time t bv D(t). For the follow- ing, do the full no-arbitrage argument (a) For American call and put options values C(t), P(t), can we have S(t) D(t) - K> C(t) - P(t) ? Can we have C(t) Pt)> S(t) Ke? Explain why. (b) Can the price of the American put be strictly less than the amount of (K S(0))? Explain why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts