Question: 2. Assume the current term structure for the dollar and British pound. The current spot rate is $1.35/E and the notional principal is $100,000,000. Swap

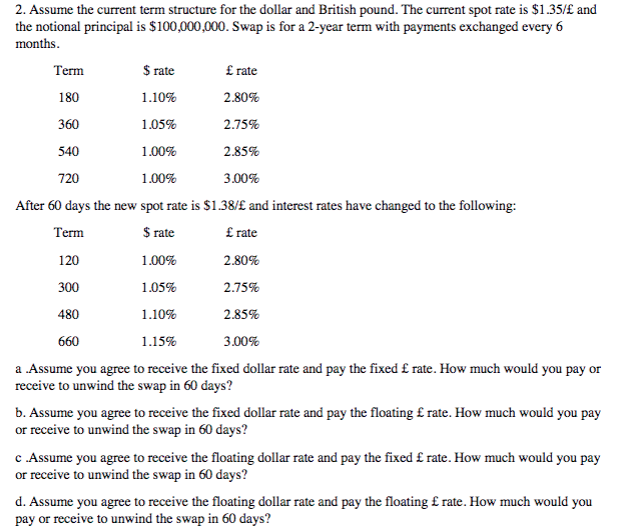

2. Assume the current term structure for the dollar and British pound. The current spot rate is $1.35/E and the notional principal is $100,000,000. Swap is for a 2-year term with payments exchanged every 6 months Term 180 360 540 720 $ rate 1.10% 1.05% 1.00% 1.00% rate 2.80% 2.75% 2.85% 3.00% After 60 days the new spot rate is $1.38/E and interest rates have changed to the following: Term 120 300 480 660 $ rate 1.00% 1.05% 1.10% 1.15% rate 2.80% 2.75% 2.85% 3.00% a Assume you agree to receive the fixed dollar rate and pay the fixedrate. How much would you pay or receive to unwind the swap in 60 days? b. Assume you agree to receive the fixed dollar rate and pay the floating rate. How much would you pay or receiv e to unwind the swap in 60 days? c Assume you agree to receive the floating dollar rate and pay the fixed rate. How much would you pay or receiv e to unwind the swap in 60 days? d. Assume you agree to receive the floating dollar rate and pay the floating rate. How much would you pay or receiv e to unwind the swap in 60 days

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts