Question: (2) Assuming that both variables x and y defined in problem (1) can only take integer values, solve the above question again using Branch-Bound solution

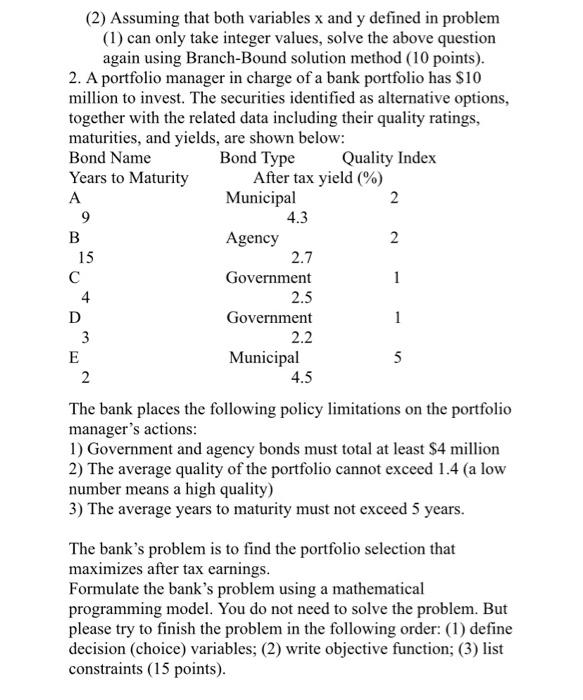

(2) Assuming that both variables x and y defined in problem (1) can only take integer values, solve the above question again using Branch-Bound solution method (10 points). 2. A portfolio manager in charge of a bank portfolio has $10 million to invest. The securities identified as alternative options, together with the related data including their quality ratings, maturities, and yields, are shown below: Bond Name Bond Type Quality Index Years to Maturity After tax yield (%) A Municipal 2 9 4.3 B Agency 2 15 2.7 C Government 1 4 2.5 D Government 1 3 2.2 E Municipal 5 2 4.5 The bank places the following policy limitations on the portfolio manager's actions: 1) Government and agency bonds must total at least $4 million 2) The average quality of the portfolio cannot exceed 1.4 (a low number means a high quality) 3) The average years to maturity must not exceed 5 years. The bank's problem is to find the portfolio selection that maximizes after tax earnings. Formulate the bank's problem using a mathematical programming model. You do not need to solve the problem. But please try to finish the problem in the following order: (1) define decision (choice) variables; (2) write objective function; (3) list constraints (15 points). (2) Assuming that both variables x and y defined in problem (1) can only take integer values, solve the above question again using Branch-Bound solution method (10 points). 2. A portfolio manager in charge of a bank portfolio has $10 million to invest. The securities identified as alternative options, together with the related data including their quality ratings, maturities, and yields, are shown below: Bond Name Bond Type Quality Index Years to Maturity After tax yield (%) A Municipal 2 9 4.3 B Agency 2 15 2.7 C Government 1 4 2.5 D Government 1 3 2.2 E Municipal 5 2 4.5 The bank places the following policy limitations on the portfolio manager's actions: 1) Government and agency bonds must total at least $4 million 2) The average quality of the portfolio cannot exceed 1.4 (a low number means a high quality) 3) The average years to maturity must not exceed 5 years. The bank's problem is to find the portfolio selection that maximizes after tax earnings. Formulate the bank's problem using a mathematical programming model. You do not need to solve the problem. But please try to finish the problem in the following order: (1) define decision (choice) variables; (2) write objective function; (3) list constraints (15 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts