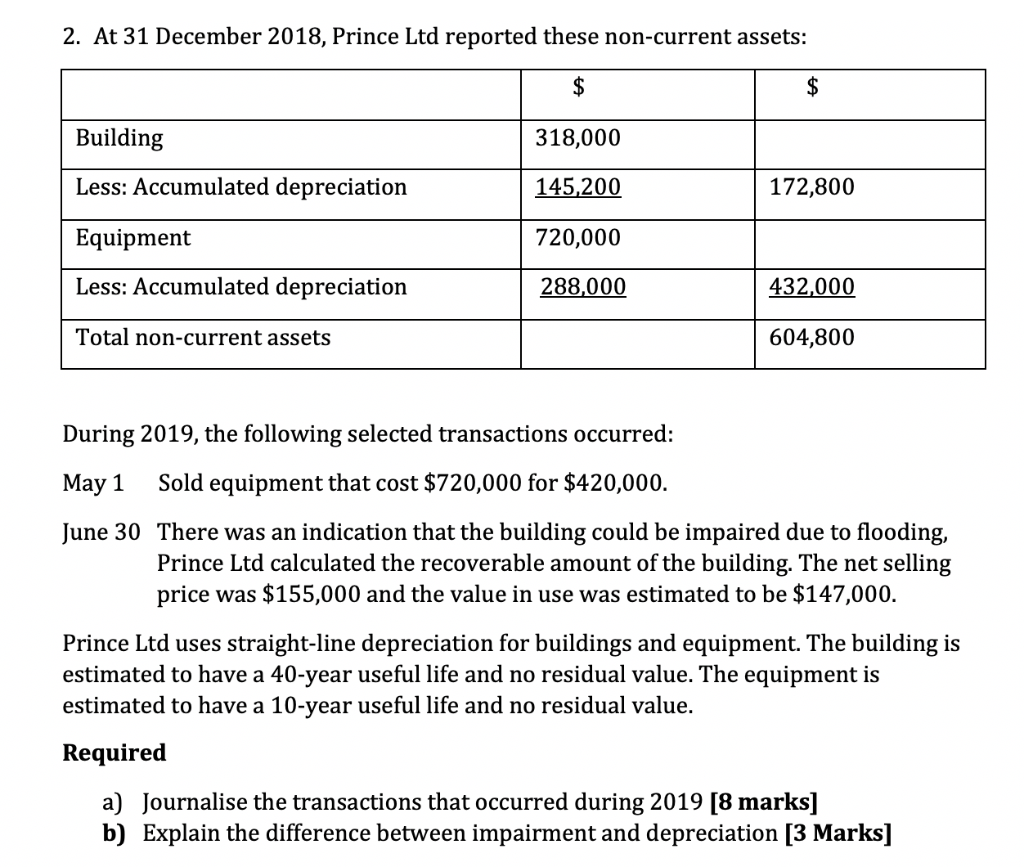

Question: 2. At 31 December 2018, Prince Ltd reported these non-current assets: $ $ Building 318,000 Less: Accumulated depreciation 145,200 172,800 Equipment 720,000 Less: Accumulated depreciation

2. At 31 December 2018, Prince Ltd reported these non-current assets: $ $ Building 318,000 Less: Accumulated depreciation 145,200 172,800 Equipment 720,000 Less: Accumulated depreciation 288,000 432,000 Total non-current assets 604,800 During 2019, the following selected transactions occurred: May 1 Sold equipment that cost $720,000 for $420,000. June 30 There was an indication that the building could be impaired due to flooding, Prince Ltd calculated the recoverable amount of the building. The net selling price was $155,000 and the value in use was estimated to be $147,000. Prince Ltd uses straight-line depreciation for buildings and equipment. The building is estimated to have a 40-year useful life and no residual value. The equipment is estimated to have a 10-year useful life and no residual value. Required a) Journalise the transactions that occurred during 2019 [8 marks] b) Explain the difference between impairment and depreciation [3 Marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts