Question: 2 Award: 10.00 points Problems? Adjust credit for all students. On January 1, 2018, Wellburn Corporation leased an asset from Tabitha Company. The asset originally

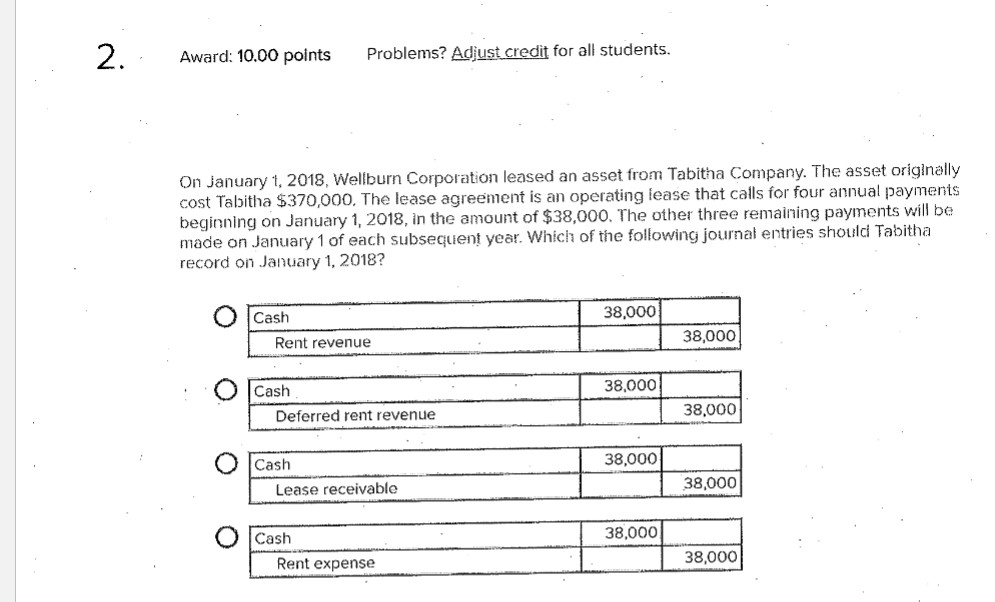

2 Award: 10.00 points Problems? Adjust credit for all students. On January 1, 2018, Wellburn Corporation leased an asset from Tabitha Company. The asset originally cost Tabitha $370,000. The lease agreement is an operating lease that calls for four annual payments beginning on January 1, 2018, in the amount of $38,000. The other three remaining payments will be made on January 1 of each subsequent year. Which of the following journal entries should Tabitha record onJauary 1, 2018? Cash 38,000 Rent revenue 38,000 Cash 38,000 Deferred rent revenue 38,000 Cash 38,000 Lease receivabla 38,000 Cash 38,000 Rent expense 38,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts