Question: 2. Based on past market data, a risky asset having today's value S(t = 0) = $65 has drift and volatility equal to = 0.03/month

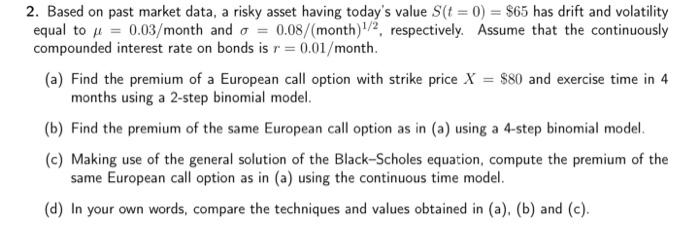

2. Based on past market data, a risky asset having today's value S(t = 0) = $65 has drift and volatility equal to = 0.03/month and o = 0.08/(month)/2, respectively. Assume that the continuously compounded interest rate on bonds is r=0.01/month. (a) Find the premium of a European call option with strike price X = $80 and exercise time in 4 months using a 2-step binomial model. (b) Find the premium of the same European call option as in (a) using a 4-step binomial model. (c) Making use of the general solution of the Black-Scholes equation, compute the premium of the same European call option as in (a) using the continuous time model. (d) In your own words, compare the techniques and values obtained in (a), (b) and (c). 2. Based on past market data, a risky asset having today's value S(t = 0) = $65 has drift and volatility equal to = 0.03/month and o = 0.08/(month)/2, respectively. Assume that the continuously compounded interest rate on bonds is r=0.01/month. (a) Find the premium of a European call option with strike price X = $80 and exercise time in 4 months using a 2-step binomial model. (b) Find the premium of the same European call option as in (a) using a 4-step binomial model. (c) Making use of the general solution of the Black-Scholes equation, compute the premium of the same European call option as in (a) using the continuous time model. (d) In your own words, compare the techniques and values obtained in (a), (b) and (c)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts