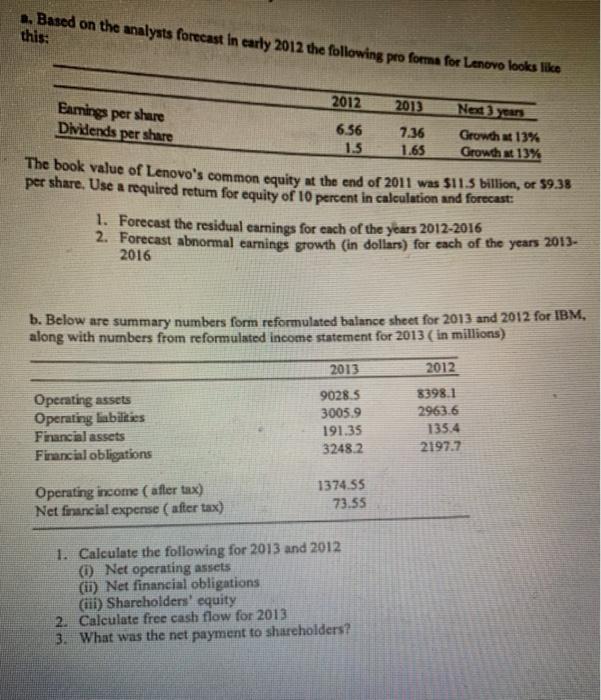

Question: 2. Based on the analysts forecast in early 2012 the following pro forma for Lenovo looks like this: 1.5 2012 2013 Nes) years Eamings per

2. Based on the analysts forecast in early 2012 the following pro forma for Lenovo looks like this: 1.5 2012 2013 Nes) years Eamings per share 6.56 7.36 Growth at 13% Dividends per share 1.65 Growth st 13% The book value of Lenovo's common equity at the end of 2011 was $11.5 billion, or $9.38 per share. Use a required retum for equity of 10 percent in calculation and forecast: 1. Forecast the residual earnings for each of the years 2012-2016 2. Forecast abnormal earnings growth (in dollars) for each of the years 2013- 2016 b. Below are summary numbers form reformulated balance sheet for 2013 and 2012 for IBM. along with numbers from reformulated income statement for 2013 ( in millions) 2013 2012 Operating assets Operating liabilities Financial assets Financial obligations 9028.3 3005.9 191.35 3248.2 8398.1 29636 135.4 2197.7 Operating income (after tax) Net financial expense (after tax) 1374.55 73.55 1. Calculate the following for 2013 and 2012 (i) Net operating assets (ii) Net financial obligations (iii) Shareholders' equity 2. Calculate free cash flow for 2013 3. What was the net payment to shareholders

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts