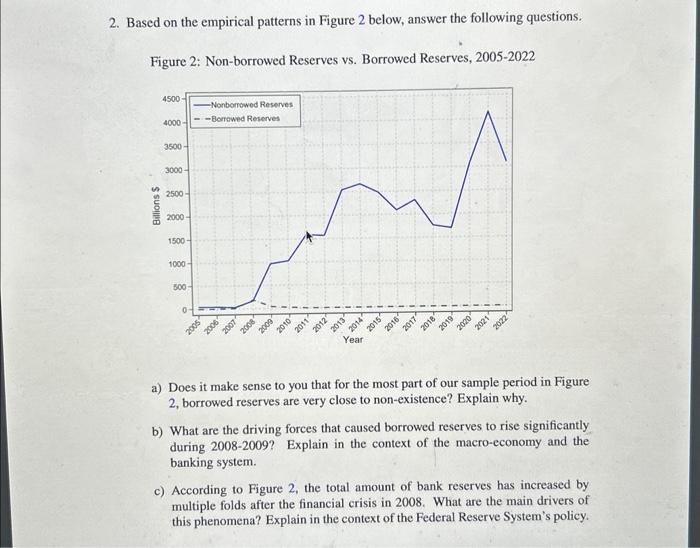

Question: 2. Based on the empirical patterns in Figure 2 below, answer the following questions. Figure 2: Non-borrowed Reserves vs. Borrowed Reserves, 2005-2022 a) Does it

2. Based on the empirical patterns in Figure 2 below, answer the following questions. Figure 2: Non-borrowed Reserves vs. Borrowed Reserves, 2005-2022 a) Does it make sense to you that for the most part of our sample period in Figure 2 , borrowed reserves are very close to non-existence? Explain why. b) What are the driving forces that caused borrowed reserves to rise significantly during 2008-2009? Explain in the context of the macro-economy and the banking system. c) According to Figure 2, the total amount of bank reserves has increased by multiple folds after the financial crisis in 2008. What are the main drivers of this phenomena? Explain in the context of the Federal Reserve System's policy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts