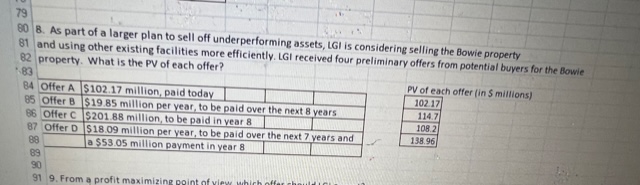

Question: 2. Based on your calculations in Tab 2, Question 8, which offer should LGI accept for the Bowie plant? Explain why. Be sure to include

2. Based on your calculations in Tab 2, Question 8, which offer should LGI accept for the Bowie plant? Explain why. Be sure to include the concepts of risk and potential return as part of your discussion.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts